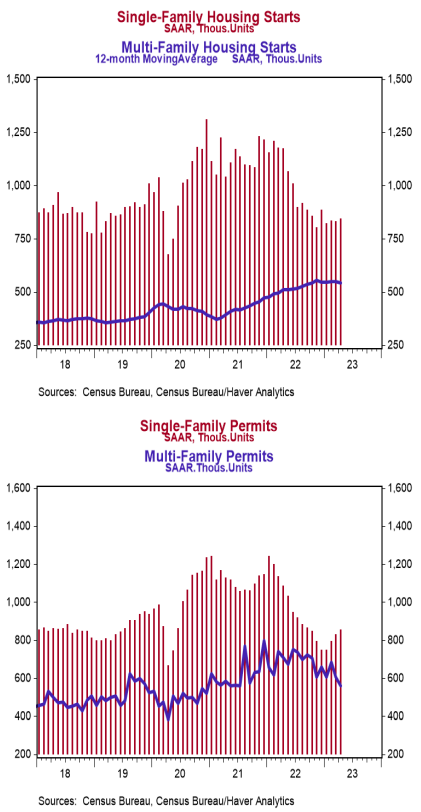

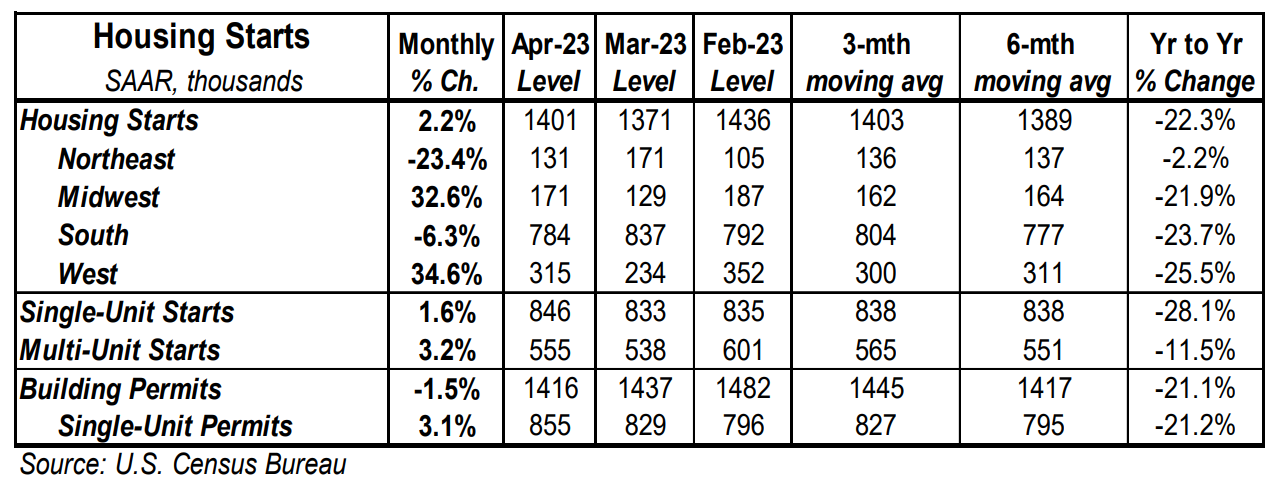

- Housing starts increased 2.2% in April to a 1.401 million annual rate, narrowly beating the consensus expected 1.400 million. Starts are down 22.3% versus a year ago.

- The gain in April was due to both single-family and multi-unit starts. In the past year, single-family starts are down 28.1% while multi-unit starts are down 11.5%.

- Starts in April rose in the Midwest and West but fell in the Northeast and South.

- New building permits declined 1.5% in April to a 1.416 million annual rate, below the consensus expected 1.430 million. Compared to a year ago, permits for single-family homes are down 21.2% while permits for multi-unit homes are down 21.0%.

Implications:

Home building rose slightly in April as developers continue to navigate a challenging housing market. Looking at the details, both single-family and multi-unit starts contributed to the headline gain in April, although starts were revised down for prior months. Developers continue to be cautious with the 30-year mortgage rate hovering near 7%. However, it does look like single-family construction has found at least a temporary bottom. One reason may be that some of the sticker shock from the rapid run-up in financing costs last year is beginning to wear off. This is good news for overall starts because single-family construction has been largely responsible for the decline in activity in the past year. Though groundbreaking on new residential projects is down 22.3% from a year ago, keep in mind that construction overall has hardly ground to a halt. Lots of projects were already in the pipeline, with the number of homes under construction hovering near the highest level on record back to 1970. These figures also demonstrate a slower construction process due to a lack of workers and other supply chain issues. Given that builders already have their hands full, it was not surprising to see permits for new projects fall 1.5% in April. While we don’t think housing is going to be a source of economic growth in the year ahead, recent numbers are not what you’d expect to see if there was a severe housing bust like the 2000s on the way, either.