View from the Observation Deck

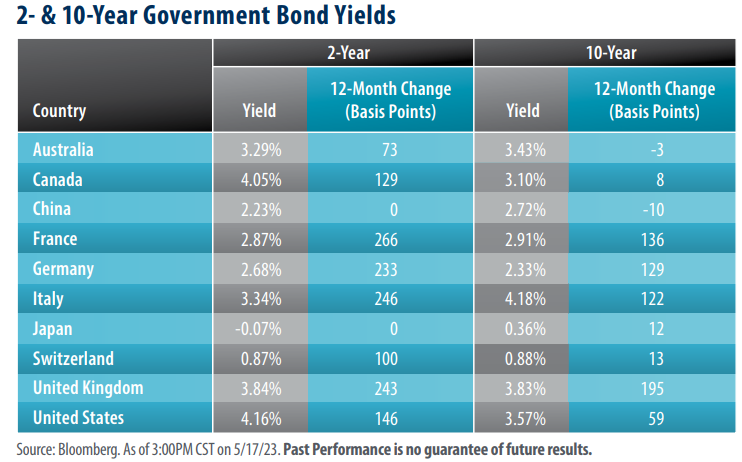

We like to update today’s table on a regular basis to show the effect monetary policy could be having on government bond yields. As many investors are aware, global central banks have been tightening monetary policy as they battle inflation, leading to increased yields. In the U.S., for example, the Federal Reserve increased the federal funds rate from 0.50%, where it stood on 4/29/22, to 5.25% as of 5/3/23. Despite these higher policy rates, headline inflation remains elevated in nine of the ten countries listed in today’s table (China being the exception).

The yield curve between the 10-Year Treasury Note (T-note) and the 2-Year T-note remains inverted in the U.S.

Historically, an inverted yield curve has been a fairly accurate indicator of an impending economic recession. Data from the Federal Reserve Bank of San Francisco shows that an inverted yield curve has been a precursor to each of the last 10 economic recessions in the U.S. since 1955. As of 5/17/23, the yield on the 2-year T-note sits 59 basis points (bps) above the yield on the 10-year T-note (see table).

Negative real yields on government bond issues remain the rule rather than the exception.

As shown in the columns marked “12-Month Change (Basis Points)”, yields on most of the government bonds in today’s table reflect increases over the past 12-months. That said, even though policy rates and yields rose over the period, the 10-year bonds of nine of the ten countries represented in today’s table reflect negative real yields (yield minus inflation). As of 5/17/23, China is the only country that does not have a negative real yield. Click here to view our post from 5/16/23, where we wrote about the real yield on the 10-year T-note in more detail.

Takeaway

Despite the tighter monetary policies enacted by central banks around the world, inflation remains stubbornly high. All but one of the countries in today’s table has a headline inflation reading that is above their stated target rate (China being the exception). The impact of higher interest rates on bond yields has been notable, with most of the countries in today’s table experiencing year-over-year (y-o-y) yield growth, and many of them experiencing y-o-y yield growth of 100 bps or more. That said, the effects of inflation are reflected in the real yields of these government issues. As mentioned above, real yields are negative for nine of the ten countries represented in the table.