View from the Observation Deck

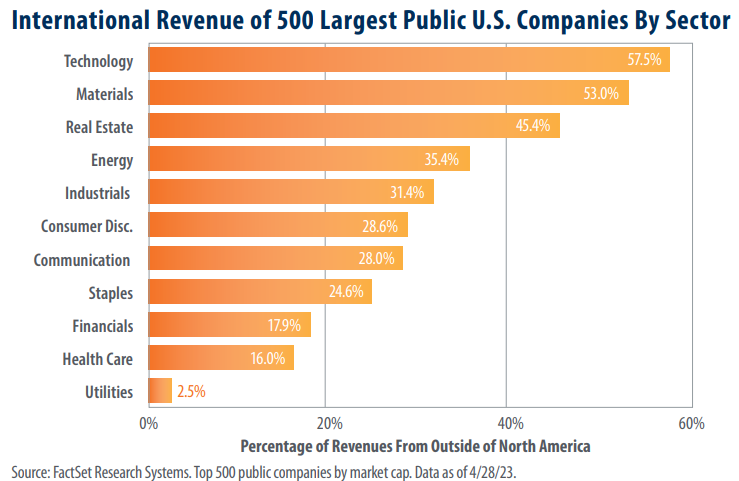

In our last blog post (Click here for “Recession? Don’t Ask The Equity Markets...” we provided a geographic breakdown of the revenue streams of the 500 largest publicly traded U.S. companies. While there are a myriad of factors that affect market performance and returns, we were curious as to what the data would reveal if we sorted the 500 companies from our previous post by sector. In the chart above, we show the 500 largest publicly traded U.S. companies (by market cap) categorized by sector and then ranked by the percentage of their revenue that was generated outside of North America.

Information Technology, Materials, Real Estate, Energy, and Industrials have the highest exposure to revenue from outside of North America (see chart).

For the sake of transparency, it should be noted that just two of the 500 companies represented in today’s chart are classified as real estate, and the results should be viewed through that lens. That said, the chart reveals that a staggering 57.5% of the revenue generated by technology stocks is derived from outside of North America. We find this fact interesting because technology stocks, as measured by the S&P 500 Information Technology Index, have posted the highest total return of the eleven sectors that comprise the S&P 500 Index between 9/30/22 and 5/8/23 (the same time frame used in the previous post).

All eleven sectors that comprise the S&P 500 Index posted positive total returns between 9/30/2022 and 5/8/23.

The three top performing sectors and their total returns over the time frame are as follows: Information Technology (28.94%); Communication Services (22.03%); and Industrials (20.85%). The three worst performing sectors over the period and their total returns were: Consumer Discretionary (3.21%); Real Estate (5.20%); and Utilities (6.85%). For comparison, the S&P 500 posted a total return of 16.54% over the time frame.

Takeaway

As the name of our blog suggests, we believe that cash flows are the lifeblood of corporations. In our view, publicly traded U.S. companies with diverse geographic cash flows may be able to weather economic difficulty more readily that those without. According to projections from the IMF, GDP growth rates in emerging and developing economies are forecast to slow at a lower rate than the U.S. Additionally, many pundits are forecasting a recession to occur in the U.S. at some point this year. In light of these projections, we believe that investors may benefit from exposure to sectors that contain companies with geographically diverse revenue streams.