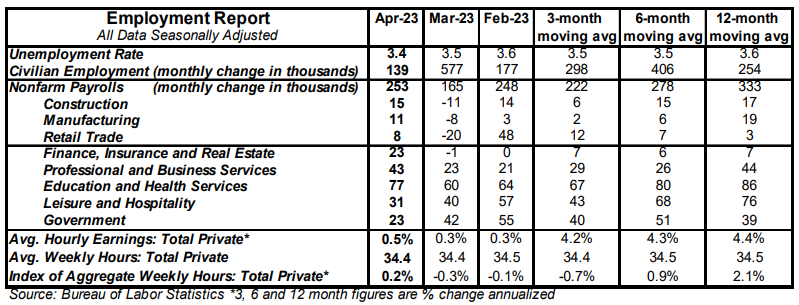

- Nonfarm payrolls increased 253,000 in April, beating the consensus expected 185,000. Payroll gains for February and March were revised down by a total of 149,000, bringing the net gain, including revisions, to 104,000.

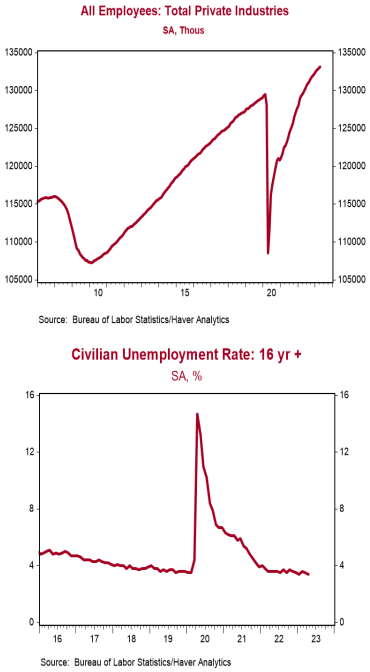

- Private sector payrolls rose 230,000 in April but were revised down 139,000 in prior months. The largest increases in April were for education & health services (+77,000), professional & business services (+43,000, including temps), and leisure & hospitality (+31,000). Manufacturing rose 11,000 while government increased 23,000.

- The unemployment rate ticked down to 3.4% from 3.5% in March.

- Average hourly earnings – cash earnings, excluding irregular bonuses/commissions and fringe benefits – rose 0.5% in April and are up 4.4% versus a year ago. Aggregate hours increased 0.2% in April and are up 2.1% from a year ago.

Implications:

This is not Goldilocks. If you want to understand where the economy is right now, you need to get comfortable with ambiguity. Once again, we have a report on the labor market with solid headlines but worrisome details. Nonfarm payrolls increased 253,000 in April, beating the consensus expected 185,000. Adding to the good news, the unemployment rate ticked down to 3.4%, tying the lowest level since the early 1950s. But if you stop after reading these headlines you’re not getting a full picture of the labor market. Yes, payrolls rose 253,000, but they were also revised down 149,000 for the prior two months, bringing the net gain to a tepid 104,000. Meanwhile, civilian employment, an alternative measure of job growth that includes small business start-ups, increased 139,000, also a tepid number. The modest growth in employment resulted in a decline in the unemployment rate because it was paired with a 43,000 decline in the labor force, which is not good news. At this point in the business cycle it’s important to separate two different angles on the labor market: the level versus the direction. The level of the labor market is strong: unemployment is low, businesses are still hiring, and it’s relatively easy to get a job. However, improvements in the labor market have slowed down and we expect that trend to intensify to the point where jobs are declining and unemployment rising later this year. The most ambiguous part of the report was the 0.5% increase in average hourly earnings. All else equal, faster wage growth is good for workers. But, given our forecast of 0.5% consumer price inflation for April, recent wage growth leaves workers barely treading water relative to prices. And wages are down relative to prices in the past year, up 4.4% versus April 2022 while consumer prices are up 5%+. Yet the Fed won’t see a wage gain of 0.5% as victory against inflation, which means the markets are underestimating the odds of another rate hike in June.