View from the Observation

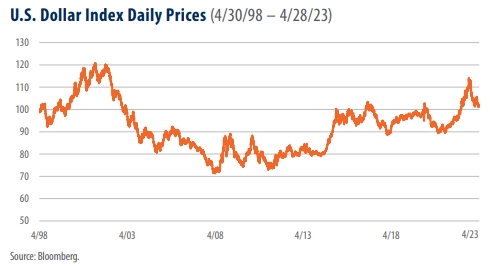

Deck At one of my recent talks, I asked whether the audience believed the U.S. dollar was stronger or weaker today than it was 25 years ago. The overwhelming response was that the dollar had weakened substantially when compared to its peers over that time frame. Predicting the direction of the dollar, or any currency, can be a daunting task, even for professionals who specialize in it. One thing we can provide is some context. Today’s chart serves to do just that.

A quick word about the index (DXY) used in today’s chart.

The DXY Currency Index is a measure of the value of the U.S. dollar against a weighted basket of six currencies used by U.S. trade partners. The basket is comprised of the Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona, and the Swiss Franc.

The index rose by 1.95% over the 25-year period ended 4/28/23.

As can be seen the chart, while the dollar has experienced significant volatility over the past 25 years, its closing price of 101.66 on 4/28/23 was 1.95% higher than where it stood on 4/30/98, when it closed at

99.71.

The U.S. dollar exhibited significant price swings throughout the period represented in the chart.

The high for the 25-year period was $120.90 which was set on 7/5/01. The low for the period occurred on 4/22/08 when the dollar bottomed at $71.33. In the past 12 months, the U.S. Dollar Index ranged from as low as 101.01 (4/13/23) to as high as 114.11 (9/27/22). Additionally, the U.S. Dollar Index has closed trading above the 100 mark in every trading session since 4/13/22, according to data from Bloomberg. The relative value of the dollar has been boosted by the Federal Reserve’s (“Fed”) aggressive rate hikes and forward guidance as well as foreign investors using the dollar as a safe haven over the past year as the war between Russia and Ukraine raged on, in our opinion.

Takeaway

Regardless of popular perception, the U.S. dollar strengthened when compared to a basket of its peers over the past 25 years. In our view, the relative value of the U.S. dollar has been boosted by the Fed’s rate hikes, the continuation of its quantitative tightening program to pare down the assets on its balance sheet (at a pace of up to $95 billion per month), and foreign investors using the dollar as a safe haven amidst geopolitical turmoil. Additionally, the Fed’s decision to increase interest rates an additional 25 basis points on 5/3/23 will likely provide ballast to the dollar, in our opinion.