View from the Observation Deck

We update today’s table on a regular basis to provide insight into the variability of sector performance by market capitalization. As of the close on 4/21/23, the S&P 500 Index stood 13.82% below its all-time closing high, according to data from Bloomberg. The S&P MidCap 400 and S&P SmallCap 600 Indices stood 14.15% and 20.87% below their respective all-time highs.

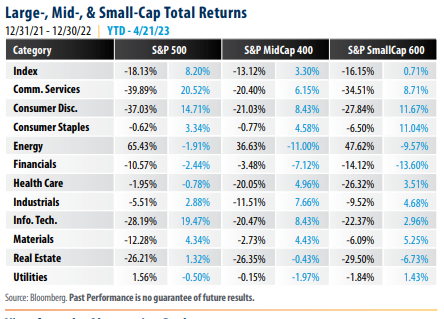

• Large-cap stocks, as represented by the S&P 500 Index “(LargeCap Index”), posted year-to-date (YTD) total returns of 8.20%, significantly outperforming the S&P MidCap 600 (“MidCap Index”) and S&P SmallCap 400 (“SmallCap Index”) indices, with total returns of 3.30% and 0.71%, respectively, over the period (see table).

• Sector performance can vary widely by market cap and have a significant impact on overall index performance. Three of the more extreme cases in 2022 were Energy, Communication Services, and Consumer Discretionary. In 2023, it is Communication Services, Financials, Technology, and Energy that appear to be contributing the most to the performance differential between the selected market caps.

Communication services stocks, which have been among the top performing sectors YTD, represented 8.04% of the weight of the LargeCap Index at the close of 4/24/23. By comparison, communication services stocks made up just 2.12% and 2.27% of the MidCap and SmallCap indices, respectively. Additionally, recent turmoil in the global banking system appears to have had an outsized impact on mid and small-sized financial companies when compared to their larger counterparts. As the table reveals, financial companies in the MidCap and SmallCap indices have suffered YTD total returns of -7.12% and -13.60%, respectively. For comparative purposes, even though financials are the worst performing sector in the LargeCap Index, they only experienced losses of -2.44% over the period.

• As of the close on 4/24/23, the price-to-earnings (P/E) ratios of the three indices in today’s table were as follows: S&P 500 Index P/E: 18.59; S&P Midcap 400 Index P/E: 12.47; S&P SmallCap 600 Index P/E: 13.02.

P/E ratios have come down for all three of these indices since our last post on this topic (Click here to view that post). That said, when viewed strictly through the lens of valuations, U.S. mid and small-sized companies continue to offer more attractive P/E ratios when compared to their larger counterparts. We would like to note, however, that if the U.S. economy continues to weaken in the coming months, it is our opinion that investors may seek out the stability that larger, more established companies tend to offer. In our view, this would likely add ballast to the prices of those larger companies.

Takeaway

From a valuation perspective, mid-cap and small-cap stocks remain attractive when compared to their large-cap peers. That said, larger companies can be viewed by some investors as being more stable during periods of economic turmoil. If economic data continues to sour in the coming months, it is possible that large-cap stocks could continue to enjoy the performance advantage they’ve built over their peers. On the other hand, investors with longer time horizons may view the current valuations in small and mid-cap stocks as comparative bargains. Over the 10-year period ended 4/24/23, the average monthly P/E ratios for the three indices was as follows: S&P 500 Index: 20.30; S&P MidCap 400 Index: 21.66, and S&P SmallCap 600 Index: 25.93, according to data from Bloomberg. As of market close on 4/24/23 the P/E ratios for those indices stood at 18.59, 12.47, and 13.02, respectively.