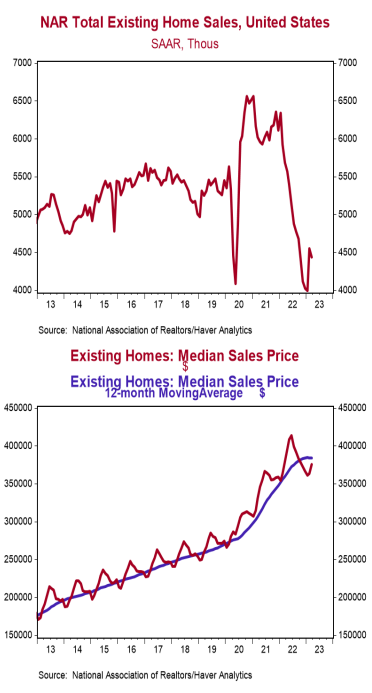

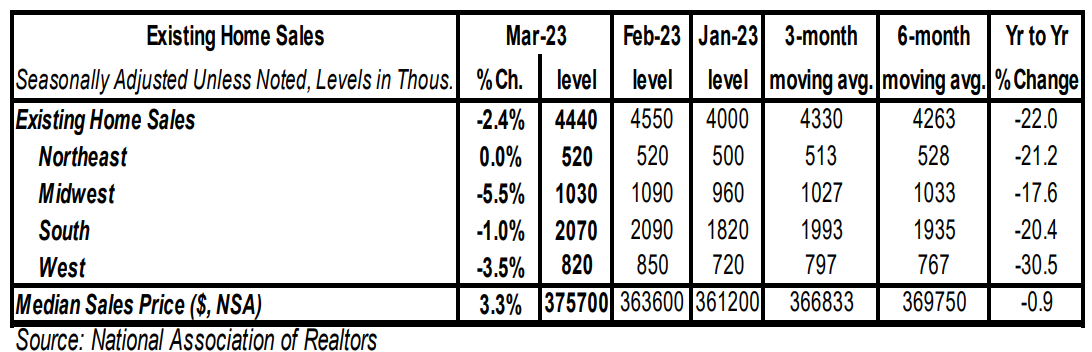

- Existing home sales declined 2.4% in March to a 4.440 million annual rate, lagging the consensus expected 4.500 million. Sales are down 22.0% versus a year ago.

- Sales fell in the Midwest, West, and South, but remained unchanged in the Northeast. The drop was due to a decline in sales of single-family homes. Sales of condos/co-ops were unchanged in March.

- The median price of an existing home rose to $375,700 in March (not seasonally adjusted) but is down 0.9% versus a year ago.

Implications:

Existing home sales moderated in March after a surge in February. We expect the outlook to be choppy moving forward as the housing market faces a series of crosswinds. First, mortgage rates that are currently hovering near 7% remain a headwind to activity. Assuming a 20% down payment, the rise in mortgage rates since March 2022 amounts to a 22% increase in monthly payments on a new 30-year mortgage for the median existing home. The shock of higher financing costs on non-homeowners (potential buyers) meant a short-term reduction in sales in 2022; but that negative impact should be diminishing as people adapt to a higher level of rates. While financing costs remain a burden, the good news for prospective buyers is that median prices fell on a year-over-year basis in March and are down 12.7% from their peak in mid-2022, which should help boost future sales. Meanwhile, many homeowners will be reluctant to sell due to a “mortgage lock-in” phenomenon, after buying or refinancing at much lower rates before 2022. That should limit future sales (and inventories). While we expect a continued moderation in national listing prices, a tight inventory of existing homes should prevent a repeat of 2008. Case in point, the months’ supply of homes (how long it would take to sell existing inventory at the current very slow sales pace) was 2.6 in March, well below the benchmark of 5.0 that the National Association of Realtors uses to denote a normal market. Finally, a weakening economy in which the Federal Reserve doesn’t act quickly to cut rates because of high inflation could be a headwind for home sales later this year. On top of this, new fee changes that will go into effect May 1st as part of the Federal Housing Finance Agency’s push for affordable housing will effectively subsidize homebuyers and refinancers with riskier credit ratings by charging higher fees to those with good credit scores. These changes are likely to cause extreme confusion and result in pricier monthly mortgage payments for most homebuyers. Adding this all together, expect sales and prices to drag on in the year ahead, with no persistent recovery in housing until at least late 2023 or early 2024. In other news this morning, initial claims for jobless benefits rose 5,000 last week to 245,000. Continuing claims rose 61,000 to 1.865 million. These figures are consistent with slower job gains in April. Meanwhile, the Philadelphia Fed Index, which measures manufacturing sentiment in that region, fell to a reading of -31.3 in April from -23.2 in March. These data are consistent with a weakening economy and our view of an impending recession in 2023.