View from the Observation Deck

Today’s blog post is one we update on an ongoing basis to provide insight into bond prices relative to changes in interest rates. The dates in the chart are from prior posts we’ve written on this topic.

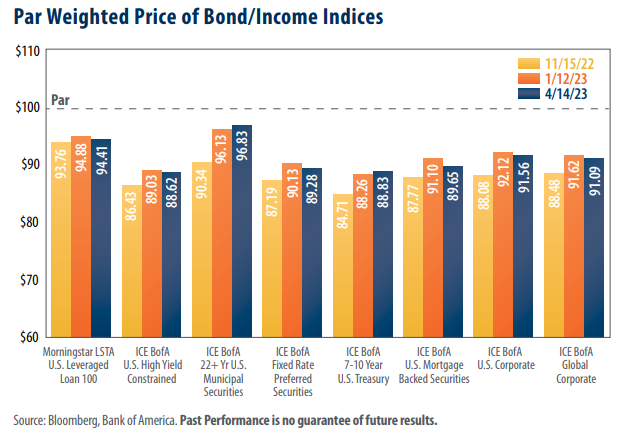

Each of the bond indices we track in today’s chart remain below par value.

Over the past 13 months, the Federal Reserve (“Fed”) announced a total of nine increases to the federal funds target rate (upper bound), sending it surging from 0.25% where it stood on 3/16/22, to 5.00% as of 4/14/23. As many investors are aware, bond prices and yields typically move in opposite directions. Therefore, an increase or decrease in bond prices could be an indication that yields have fallen or risen, respectively, over the period. While not captured by the time frame in today’s chart, seven of the eight bond indices referenced stood above their par values as of 12/15/21 (Click here to see our post from 12/16/21). For comparison, all eight were below their par values as of 4/14/23. The yield on the 10-year Treasury Note (T-note) stood at 3.52% on 4/14/23, an increase of 169 basis points (bps) from where it stood on 2/28/22.

Bond prices appear to have recovered slightly since 11/15/22.

The price of each of the indices in today’s chart show an increase over where they stood on 11/15/22. The yield on the 10-year T-note fell by 33 bps from 11/15/22 to 1/12/23 and fell by 26 bps from 11/15/22 to 4/14/23.

The trailing 12-month rate on the Consumer Price Index (CPI) stood at 5.0% as of 3/31/23, down

significantly from its most recent peak of 9.1% on 6/30/22.

While the decrease in the CPI is a welcome relief, inflation remains well above its 30-year average of 2.5%. It is possible that the Fed could see these higher-than-average CPI readings as evidence that further rate hikes are necessary, in our opinion. This, in turn, could put further pressure on bond valuations.

Takeaway

While the recent price improvements in the U.S. bond market are a welcome sight, bond investors

would be well-served to watch the Fed’s reaction to CPI data closely. Real yields (yield minus

inflation) are negative in four of the eight indices in today’s chart. If the Fed continues to tighten

monetary policy, we could see further downward price pressures in fixed income, in our opinion.