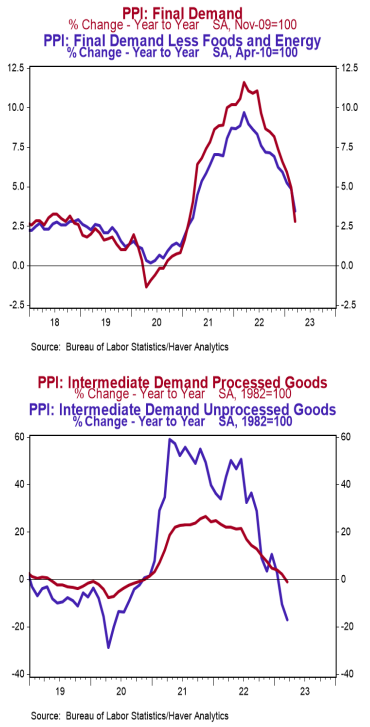

- The Producer Price Index (PPI) declined 0.5% in March, coming in well below the consensus expectation for no change. Producer prices are up 2.7% versus a year ago.

- Energy prices fell 6.4% in March, while food prices rose 0.6%. Producer prices excluding food and energy declined 0.1% in March but are up 3.4% versus a year ago.

- In the past year, prices for goods are up 2.0%, while prices for services have risen 2.8%. Private capital equipment prices declined 0.4% in March but are up 4.7% in the past year.

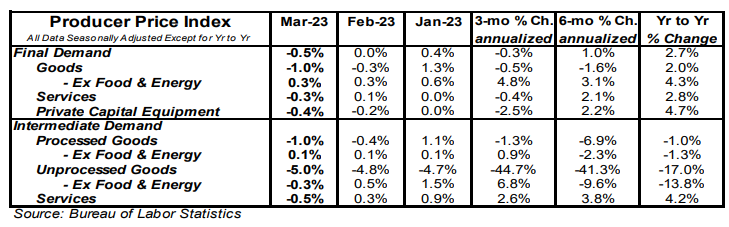

- Prices for intermediate processed goods fell 1.0% in March and are down 1.0% versus a year ago. Prices for intermediate unprocessed goods declined 5.0% in March and are down 17.0% versus a year ago.

Implications:

Producer prices in March declined by the most for any month since the shutdown-induced price plummets of early 2020, a potential sign that the drop in the M2 measure of the money supply since last year is starting to have a greater impact on the economy. The 0.5% decline in headline prices in March echoed yesterday’s CPI report in that energy was a driving force in moderating prices. However, the two reports moved in opposite directions when the typically volatile food and energy categories are removed. “Core” producer prices declined 0.1% in March and are up 3.4% in the past year. These prices have been consistently trending lower on a year-ago basis since peaking at 9.7% in March of 2022. Meanwhile, the comparable metric on the CPI side rose 0.4% in March and has remained stubbornly elevated above 5.0%. Some will argue that the moderation in producer prices – though still above the Fed’s 2.0% target on a twelve-month basis – paired with the recent turmoil in the financial sector, warrant a pause or perhaps even easing from the Federal Reserve. We think that would be a mistake. The inflation fight is far from over, and while it’s certainly possible that peak inflation is behind us, the Fed’s failures in the 1970s show the painful ramifications of stopping before the battle is fully won. Taking a look at the details of today’s report shows that the goods sector led prices lower in March, declining 1.0%. The drop in energy prices (-6.4% in March) was the key culprit, with prices for gasoline falling a massive 11.7%. Strip out just the energy category, and goods prices rose 0.4% in March. Service prices declined 0.3% in March, led by a drop in margins to wholesalers. Further back in the pipeline, lower costs remained the theme, with falling prices for both intermediate demand processed (-1.0%) and unprocessed (-5.0%) goods. Signs of easing price pressures are positive, but we aren’t yet to the finish line. In other news this morning, initial unemployment claims rose 11,000 last week to 239,000, while continuing claims fell by 13,000 to 1.823 million. These figures are consistent with continued – but slowing – job gains.