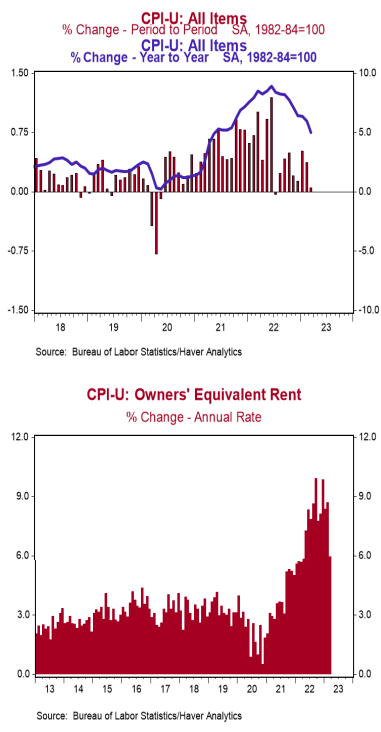

- The Consumer Price Index (CPI) rose 0.1% in March, below the consensus expected +0.2%. The CPI is up 5.0% from a year ago.

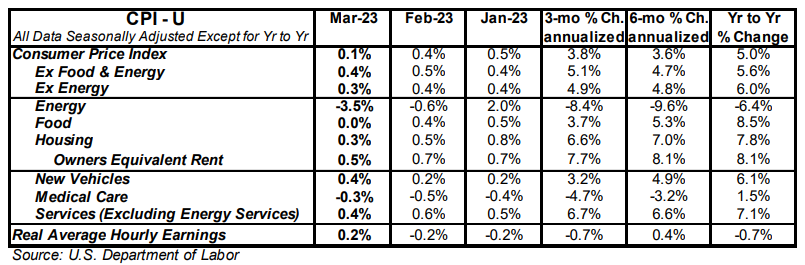

- Energy prices declined 3.5% in March, while food prices were unchanged. The “core” CPI, which excludes food and energy, rose 0.4% in March, matching consensus expectations. Core prices are up 5.6% versus a year ago.

- Real average hourly earnings – the cash earnings of all workers, adjusted for inflation – increased 0.2% in March, but are down 0.7% in the past year. Real average weekly earnings are down 1.6% in the past year.

Implications:

Headline inflation moderated in March, coming in below consensus expectations and pushing the twelve-month comparison down a full percentage point to 5.0%. However, a look at the details of the report show inflation was more of a problem than the headline suggests. Overall consumer prices were held down by the energy sector, which decreased 3.5% in March as all major energy components declined. Stripping out energy and it’s other often volatile counterpart – food prices (unchanged in March) – “core” prices rose 0.4%, matching consensus expectations, and pushing the twelve-month comparison up to 5.6% from 5.5% in February. The main driver within the core categories was once again housing rents, which rose 0.5% in March, more than offsetting the decline in energy prices. Rents for both actual tenants and the imputed rental value of owner-occupied homes are running at or above a 7% annualized rate over three, six, and twelve month timeframes. This is important because together they make up a third of the weighting in the overall index. We expect rents to continue to generate high inflation for some time as they catch up to home prices, which skyrocketed in 2020-21. Meanwhile, a subset category of inflation that the Fed is watching closely – known as the “Super Core” – which excludes food, energy, other goods, and housing rents, continued to rise at an outsized clip, increasing 0.4% in March. This measure is up at a 5.2% annualized rate in the first quarter of 2023. Unfortunately for the Fed, even after stripping out nearly every category they’ve blamed this high inflation on, it does nothing to improve the picture. Other notable core categories that increased in March were prices for airline fares (+4.0%), hotels and motels (+3.1%), and motor vehicle insurance (+1.2%). It’s also important to recognize that overall prices continue to rise despite improvements in categories that were labeled “transitory” and were consistent tailwinds to inflation during the pandemic. For example, used cars and trucks fell 0.9% in March, extending its streak to nine consecutive monthly declines. Medical care services (-0.5% in March) have declined each month in 2023 after consistently rising for most of 2021-22. Putting this altogether, inflation is still a problem in the US economy. Expect Powell and Co. to keep monetary policy tight in the months to come.