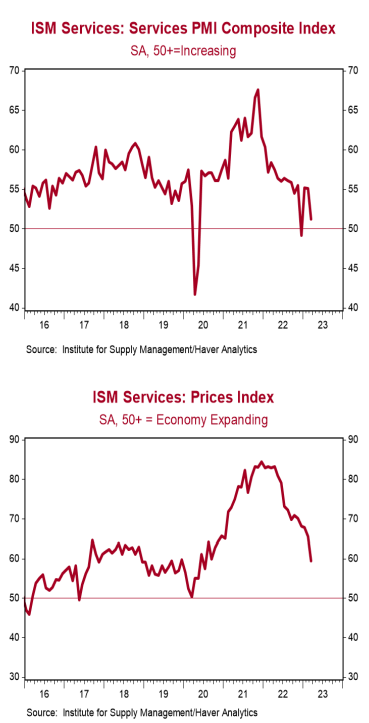

- The ISM Non-Manufacturing index dropped to 51.2 in March, well below the consensus expected 54.4. (Levels above 50 signal expansion; levels below signal contraction.)

- The major measures of activity were all lower in March. The new orders index fell to 52.2 from 62.6, while the business activity index ticked down to 55.4 from 56.3. The employment index declined to 51.3 from 54.0, while the supplier deliveries index dropped to 45.8 from 47.6.

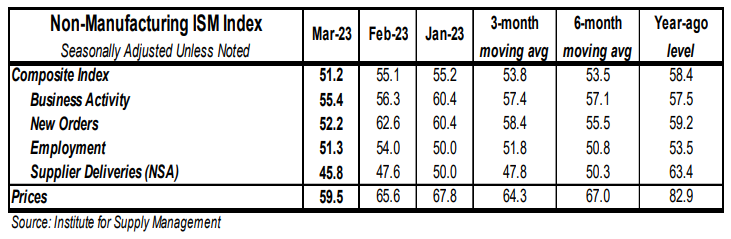

- The prices paid index declined to 59.5 in March from 65.6 in February.

Implications:

The service sector suffered slower growth in March, falling nearly four points and widely missing the consensus forecast. While the ISM Manufacturing report from Monday suggests the goods side of the economy may already be in recession, that’s not the case for the services side, just yet; thirteen out of eighteen major service industries reported growth in March. The pullback in March was mainly attributed to a cooling in the rate of growth for new orders, which fell to 52.2 from the 62.6 reading in February. Its forward-looking counterpart – business-activity – also declined but remains comfortably in expansion territory at 55.4. Survey respondents in March noted that their supply chains finally appear to be back to normal. This is good news and can be clearly seen in the supplier deliveries index which fell to 45.8 in March (levels below 50 signal shorter wait-times) which is the lowest level since 2009 and well-off the 78.3 peak seen during the COVID lockdowns in 2020. Supply chain improvements were also reflected in the prices index, which fell to the lowest level in almost three years. While that is welcome news, we think it’s too early to claim victory on inflation in the service sector; the overall index is still well above 50, and thirteen out of eighteen major industries reported paying higher prices in March. Finally, on the labor front, the employment index moderated in March but remained in expansion territory at 51.3. Respondent comments continue to signal that a lack of supply, not demand, has been what’s held back service jobs from moving higher. Comparing the two March ISM reports, it’s clear that businesses and consumers are shifting resources away from goods and toward the service sector. While the service sector does not appear to be there yet, we believe the US economy will enter a recession in 2023. We continue to think equity investors should be cautious. In other news earlier this week, automakers reported selling cars and light trucks at a 14.8 million annual rate in March, above the consensus expected 14.5 million annual rate. In the last year, sales are up 9.3%.