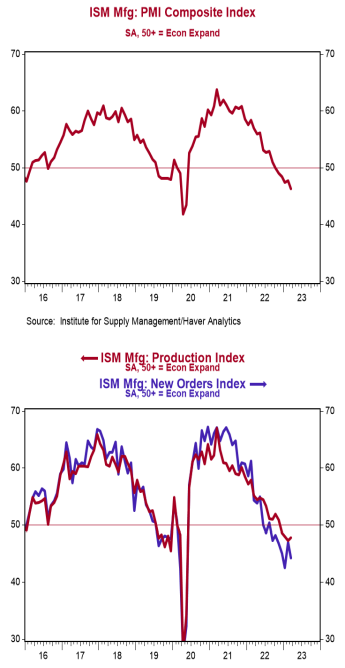

- The ISM Manufacturing Index declined to 46.3 in March, lagging the consensus expected 47.5. (Levels higher than 50 signal expansion; levels below 50 signal contraction.)

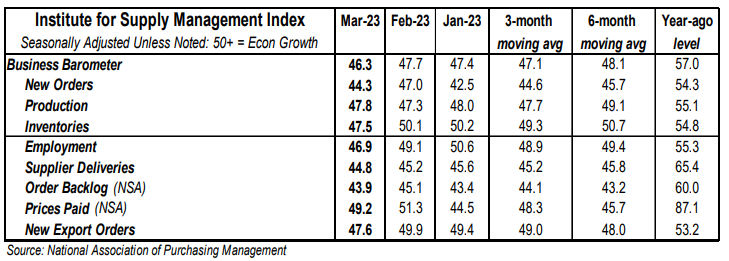

- The major measures of activity were mostly lower in March and all stand below 50, signaling contraction. The new orders index fell to 44.3 from 47.0 in February, while the production index rose to 47.8 from 47.3. The supplier deliveries index fell to 44.8 from 45.2 in February and the employment index declined to 46.9 from 49.1.

- The prices paid index fell to 49.2 in March from 51.3 in February.

Implications:

Negative news on the US economy this morning. The US manufacturing sector fell further into contraction territory in March with the overall index hitting 46.3. That’s the lowest reading since the early months of COVID and, before that, the end of the Great Recession in 2009. Only six of eighteen industries reported growth in March. Looking at the details, not a single major sub-component of the ISM manufacturing index was above 50. We continue to believe a recession is on the way in 2023 and today’s report shows that the goods sector of the economy is likely to lead the way. Survey respondents in March noted slowing demand for products as well as improvements in supply chains (fewer orders means it’s easier to fulfill the orders that are made). This was reflected in the forward-looking new orders index, which led activity lower in March after a brief rebound in February. Consumers have been shifting their preferences away from goods and back toward services. Worries about the future have also caused factories to slow down the pace of production, with that index rising slightly but remaining in contraction for the fourth consecutive month. One piece of good news is that fewer new orders and improvements in supply chains has allowed factories to catch up on order backlogs, with that index falling to 43.9 in March. Meanwhile, the employment index fell to the lowest level since the early days of the COVID pandemic in March. The hiring to reduction ratio among panelists’ comments was 1-to-1 in March and only six of eighteen industries reporting employment growth. Finally, on the inflation front, the prices index fell to 49.2 in March after briefly jumping above 50 in February. Given news of OPEC+ production cuts over the weekend and potentially higher energy prices on the horizon, this will be an important subject to follow. A rebound in goods inflation will make it even harder for the Fed to wrestle inflation down to its 2.0% target. In other news this morning, construction spending declined 0.1% in February, with a large decline in home building more than offsetting gains in manufacturing and power projects.