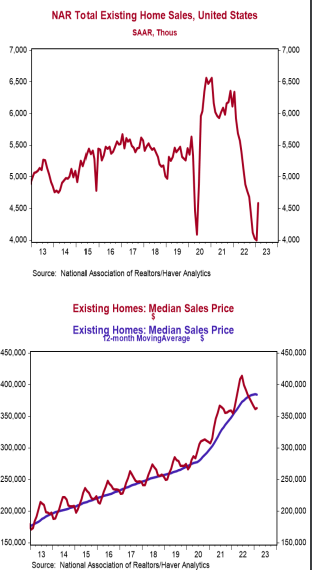

- Existing home sales increased 14.5% in February to a 4.580 million annual rate, easily beating the consensus expected 4.200 million. Sales are down 22.6% versus a year ago.

- Sales in February rose in every major region. The gain was due to both single-family homes and condos/co-ops.

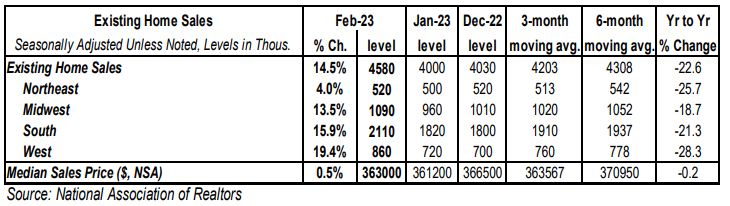

- The median price of an existing home rose to $363,000 in February (not seasonally adjusted) but is down 0.2% versus a year ago.

Implications:

Existing home sales surprised to the upside in February, rising for the first time in thirteen months and beating even the most optimistic forecast of any economics group surveyed by Bloomberg. Sales of existing homes may finally have bottomed, but we don’t expect a consistent upward trend, yet. Existing home sales are counted at closing, which means they reflect contracts signed in the two prior months. Mortgage rates temporarily declined in late 2022 and early this year, generating a bump in sales. However, mortgage rates hovering near 7% remain a headwind. Given recent instability in the banking system, there are likely still choppy waters ahead for the housing market as lenders tighten criteria for new mortgages. Regardless, when you do the math it’s not hard to see why home sales have fallen 22.6% in the past year. Assuming a 20% down payment, the rise in mortgage rates and home prices since February 2022 amounts to a 34% increase in monthly payments on a new 30-year mortgage for the median existing home. While financing costs remain a burden, the good news for prospective buyers is that median prices fell on a year-over-year basis for the first time in eleven years. We expect continued moderation in list prices in the months ahead, however nothing like the roughly 25% drop during the financial crisis. The main reason is that the inventory of existing homes on the market remains tight and we think this will remain a problem given that many homeowners locked in mortgage rates at rock bottom levels during the pandemic, and potential sellers are unlikely to brave a 300+ basis point increase in financing costs by re-entering the market to trade up. For example, the months’ supply of homes (how long it would take to sell existing inventory at the current very slow sales pace) fell to 2.6 in February, well below the benchmark of 5.0 that the National Association of Realtors uses to denote a normal market. Despite the lack of options, homes that are put on the market are still selling quickly: 57% of existing homes sold were on the market for less than a month. While sales are clearly under pressure, this is not a repeat of the 2006-11 housing bust. Unlike the previous housing bust, we do not have a massive oversupply of homes. Meanwhile, a flood of new inventories hitting the market due to foreclosure remains unlikely. Adjustable-rate mortgages make up a much smaller share of overall mortgages today than in the lead up to the prior housing crisis. Many current homeowners have locked-in fixed long-term mortgages at extremely low interest rates, which would make them very reluctant to default on their mortgage even if the economy turns for the worse. Expect sales and prices to drag on in the year ahead, with no persistent recovery in housing until at least late 2023 or early 2024.