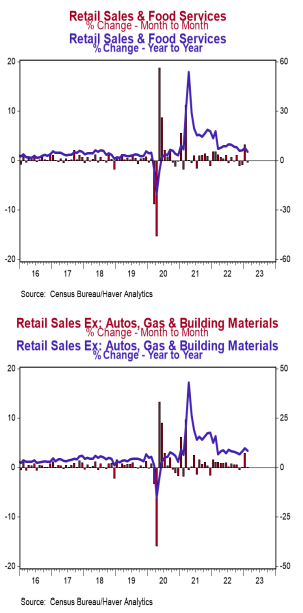

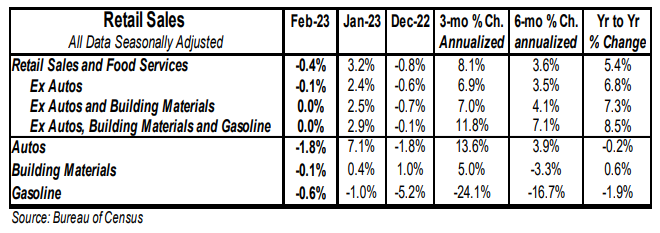

- Retail sales declined 0.4% in February (+0.1% including revisions to prior months), matching consensus expectations. Retail sales are up 5.4% versus a year ago.

- Sales excluding autos declined 0.1% in February (+0.3% including revisions to prior months), matching consensus expectations. These sales are up 6.8% in the past year.

- The largest declines in February were for autos and restaurants & bars.

- Sales excluding autos, building materials, and gas were unchanged in February. If unchanged in March, these sales will be up at a 11.2% annual rate in Q1 versus the Q4 average.

Implications:

Retail sales cooled in February after an abnormally strong print in January that had more to do with one-off factors rather than with the fundamentals of the economy. Prior months’ numbers were revised higher, as well, and, including revisions, retail sales rose 0.1%, beating the consensus expected 0.4% decline. Part of this is a payback for the massive report that came through in January, which was driven by seasonal adjustments and unusually warm weather. The weakness in retail sales in February itself was fairly widespread as eight of thirteen retail categories declined in February, led by autos and restaurant & bars; the same categories that led the surge in January. “Core” sales, which exclude the most volatile categories of autos, building materials, and gas stations, and is an important measure for estimating GDP, were unchanged in February but revised higher in prior months. If unchanged in March, these sales will be up at an 11.2% annual rate in Q1 versus the Q4 average. In the last twelve months, retail sales are up 5.4%. Yes, consumers are spending more, but they are not taking home the same amount of goods because that pace has failed to outpace inflation, with the CPI up 6.0% over the same period. Due to very loose monetary policy and the massive increase in government transfer payments in response to COVID, retail sales are still running higher than they would have had COVID never happened. However, loose monetary policy, which helped finance that big increase in government spending, is translating into high inflation, which is why “real” (inflation-adjusted) retail sales are down versus a year ago. Nothing in this report changes our fundamental view of the economy; we still believe the tightening in monetary policy since last year will deliver a recession. Ultimately what the data show is that the Federal Reserve needs to stay the course and continue to keep monetary policy tight. Given recent turmoil in the banking system, the Fed is likely to only raise short-term interest rates by a quarter percentage point next week, or maybe not raise rates at all. Unfortunately, what the Fed should do and what they will do can differ.