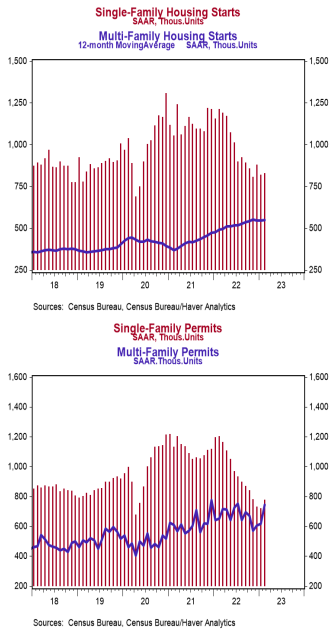

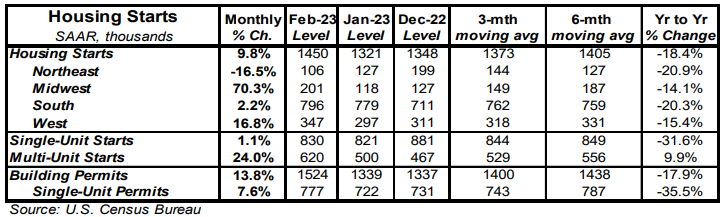

- Housing starts increased 9.8% in February to a 1.450 million annual rate, easily beating the consensus expected 1.310 million. Starts are down 18.4% versus a year ago.

- The gain in February was due to both single-family and multi-unit starts. In the past year, single-family starts are down 31.6% while multi-unit starts are up 9.9%.

- Starts in February rose in the Midwest, West and South, but fell in the Northeast.

- New building permits increased 13.8% in February to a 1.524 million annual rate, easily beating the consensus expected 1.343 million. Compared to a year ago, permits for single-family homes are down 35.5% while permits for multi-unit homes are up 14.4%.

Implications:

Housing construction showed some signs of life in February, rising for the first time in six months and coming in higher than even the most optimistic forecast by any economics group surveyed by Bloomberg. Looking at the details, multi-unit construction was the reason for most of February’s gain. Though single-family starts did eke out an increase of 1.1%, it’s clear that 30-year mortgage rates hovering near 7% are keeping developers from investing in these types of projects. That said, it looks like some of the sticker shock from the rapid run-up in financing costs last year is beginning to wear off. In fact, yesterday’s reading on homebuilder sentiment, as measured by the NAHB Housing Index, rose to 44 in March from 42 in February. This is the third consecutive gain following the longest streak of declines since records began in 1985. That said, an index reading below 50 still signals that more builders view conditions as poor vs. good. However, these data reinforce our view that the housing market is beginning to find its footing in the new higher rate environment, with developers stating that sales and prospective buyer foot traffic have been improving. Though groundbreaking on new residential projects is down 18.4% from a year ago, keep in mind that construction overall has hardly ground to a halt. Lots of projects were already in the pipeline, with the number of homes under construction hovering near the highest level on record back to 1970. These figures also demonstrate a slower construction process due to a lack of workers and other supply-chain difficulties. Given that builders already have their hands full, it was surprising to see permits for new projects jump 13.8% in February. Notably, this was the largest monthly gain in more than two years, signaling that developers may be beginning to see some light on the horizon for sales activity. While we don’t think housing is going to be a source of economic growth in the year ahead, recent news is not what you’d expect to see if there was a housing bust like the 2000s on the way either. In labor market news this morning, initial unemployment claims fell 20,000 last week to 192,000, while continuing claims declined by 29,000 to 1.684 million. Meanwhile, the Philadelphia Fed Index, which measures manufacturing sentiment in that region, rose to a still weak reading of -23.2 in March from -24.3 in February. Finally this morning, import prices declined 0.1% in February while export prices rose 0.2%. In the past year, import prices are down 1.1%, while export prices are down 0.8%. Both these pieces of data demonstrate weakness in the goods sector of the economy, which we believe will lead the way into a recession in 2023.