View from the Observation Deck

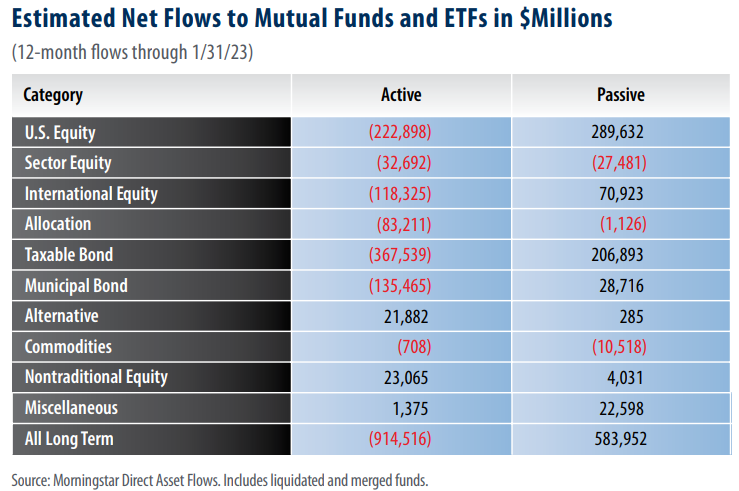

Investors directing capital into mutual funds and exchange traded funds (ETFs) continued to favor passive investing over active management on a massive scale for the 12-month period ended 1/31/23. This has been the case for the past several years. Passive mutual funds and ETFs reported estimated net inflows totaling $583.95 billion for the 12-month period ended 1/31/23 while active funds reported estimated net outflows totaling $914.52 billion over the same period. The only active categories over the past 12 months with net inflows were Nontraditional Equity, Alternative and Miscellaneous with inflows of $23.07 billion, $21.88 billion and $1.38 billion, respectively (see table above). For comparison, the top three passive categories were U.S. Equity, Taxable Bond and International Equity with inflows of $289.63 billion, $206.89 billion and $70.92 billion, respectively.

Despite lackluster returns in the major global stock indices for the 12-month period ended 1/31/23, investors funneled more capital into equities than any other category.

The S&P 500, S&P MidCap 400 and S&P SmallCap 600 Indices posted total returns of -8.23%, 2.30% and -1.00% respectively, for the 12-month period ended 1/31/23, according to Bloomberg. With respect to foreign equities, the MSCI Daily TR Net World (ex U.S.) and MSCI Emerging Net TR Indices posted total returns of -2.98% and -12.12%, respectively. Combined, the Taxable and Municipal Bond categories reported net outflows totaling $267.40 billion for the 12-month period ended 1/31/23. The U.S. Dollar Index (DXY) rose by 5.76% for the 12-month period ended 1/31/23, according to Bloomberg. The index reflects the general international value of the dollar relative to a basket of major world currencies. The stronger dollar created a drag on the performance of unhedged foreign securities held by U.S. investors, in our opinion.

Takeaway

Passive mutual funds and ETFs saw inflows of $583.95 billion compared to outflows of $914.52 billion for active funds over the trailing 12-month period ended 1/31/23. In the table above, we observe the largest disparity occurred in the Taxable Bond category, with active shedding $367.54 billion compared to inflows of $206.89 billion for passive funds. Nontraditional Equity, Alternative, and Miscellaneous were the only three categories to see inflows among both the active and passive management styles. To view the last time we updated this post, please click here.