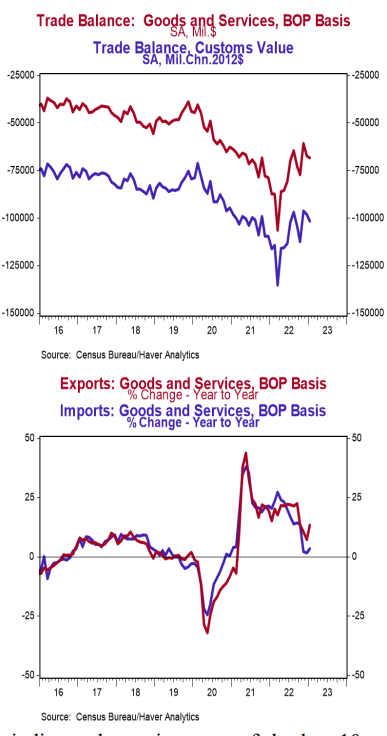

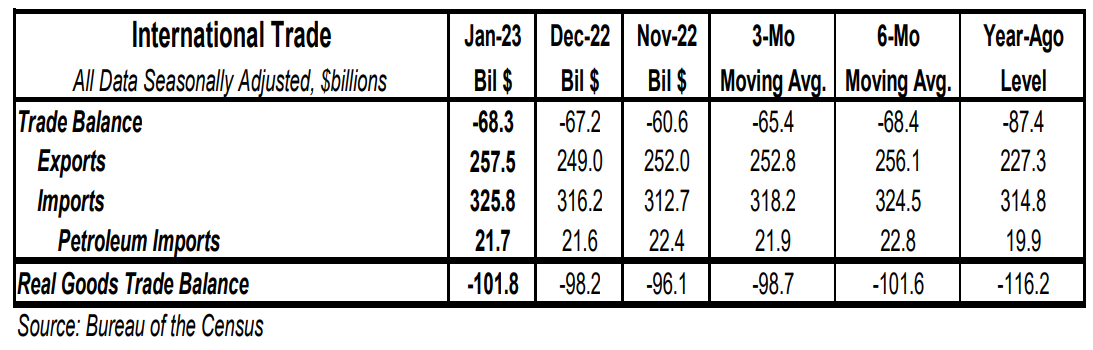

- The trade deficit in goods and services came in at $68.3 billion in January, slightly smaller than the consensus expected $68.7 billion.

- Exports rose by $8.5 billion, led by pharmaceuticals and nonmonetary gold. Imports rose by $9.6 billion, led by autos and cellphones & other household goods.

- In the last year, exports are up 13.3% while imports are up 3.5%.

- Compared to a year ago, the monthly trade deficit is $19.1 billion smaller; after adjusting for inflation, the “real” trade deficit in goods is $14.4 billion smaller than a year ago. The “real” change is the trade indicator most important for measuring real GDP.

Implications:

In January, the trade deficit in goods and services hit $68.3 billion as exports expanded faster than imports. However, we prefer to focus on the total volume of trade, imports plus exports, as it represents the extent of business and consumer interactions across the US border. This measure expanded significantly by $18.1 billion in January, increasing by 7.6% compared to a year ago, but still remains 2.8% lower than last year's peak in June. Although this growth is positive, it's worth noting that it was driven not only by an increase in goods and services but also by higher prices. It’s important to remember, too, that Russia’s invasion of Ukraine and the easing of COVID restrictions in China may affect trade patterns for some time. The good news is that supply-chain problems have improved dramatically. For example, Captain Kip, the Executive Director of Marine Exchange of Southern California, declared the container ship backup ended on November 22nd. It took twenty-five months, but things are finally back to normal at the Ports of LA and Long Beach. In some cases waits have just shifted to other ports, but daily freight rates are also falling rapidly and back to pre-COVID levels as demand has also weakened. The New York Fed’s Global Supply Pressure Index also confirmed this in February, with the index reaching negative territory for the first time since August 2019. Weaker demand coupled with an easing of parts shortages and less shipping congestion have pulled the indicator lower in seven of the last 10 months. Also notable in today’s report, the dollar value of US petroleum exports exceeded imports again. In the past year, US petroleum exports exceeded imports in ten of twelve months. For the full calendar year of 2022, the US became a net exporter again of petroleum products. What this means is much of the release from the Strategic Petroleum Reserve just flowed overseas. In labor market news this morning, the ADP employment report showed a gain of 242,000 private-sector jobs in February, above the consensus estimate of 200,000. After plugging today's numbers into our model, we expect Friday’s employment report to show a nonfarm payroll gain of 232,000.