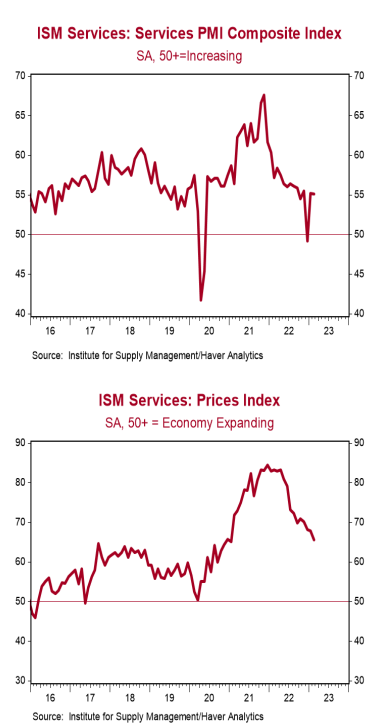

- The ISM Non-Manufacturing index ticked down to 55.1 in February, beating the consensus expected 54.5 (Levels above 50 signal expansion; levels below signal contraction.)

- The major measures of activity were mixed in February. The new orders index increased to 62.6 from 60.4, while the business activity index declined to 56.3 from 60.4. The employment index increased to 54.0 from 50.0, while the supplier deliveries index declined to 47.6 from 50.0.

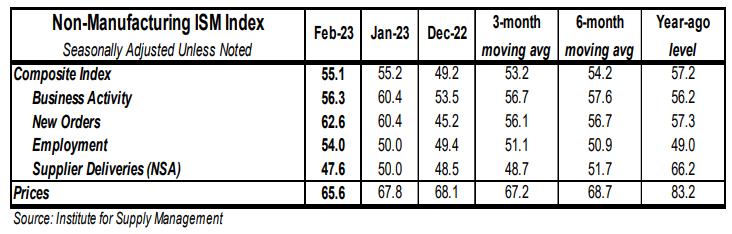

- The prices paid index declined to 65.6 in February from 67.8 in January.

Implications:

The service sector continued to expand in February, beating consensus expectations, with thirteen of eighteen industries reporting growth. Meanwhile, respondent comments were dominated by inflation woes, as companies continue to feel pinched by rising costs that show little sign of easing. This can be seen clearly in the prices index, which ticked down to a still very elevated 65.6. Though that is below its peak from the end of 2021 – make no mistake – inflation is still a major problem in the service sector, with sixteen out of eighteen industries reporting paying higher prices in February. We expect the service sector to keep inflation trending well above the Fed’s 2.0% target for some time. In terms of other details in today’s report, new orders and business activity both expanded at a healthy clip in February. At the same time, the index for supplier deliveries fell back into contraction territory to the lowest level in more than a decade, signaling shorter wait times. Finally, the employment index rose to the highest level since the end of 2021. Notably, respondent comments reported an increase in applications, which resulted in more new hires. This is good news, since a lack of supply, not demand, has been what’s held back service jobs from moving higher. Comparing the two February ISM reports, it’s clear that businesses and consumers are shifting resources away from goods and toward the service sector. While the service sector does not appear to be there yet, we believe the US economy will enter a recession in 2023. We continue to think equity investors should be cautious. One thing we are certain about; there is no such thing as a free lunch. Eventually, the bill for the massive artificial stimulus in 2020-21 will come due. In other recent news, initial unemployment claims fell 2,000 last week to 190,000, while continuing claims rose 1,000 to 1.655 million. Expect another solid payroll report for February, but not near as strong as January. Also earlier this week, automakers reported selling cars and light trucks at a 14.9 million annual rate in February, down 6.2% from January, but up 8.5% from a year ago.