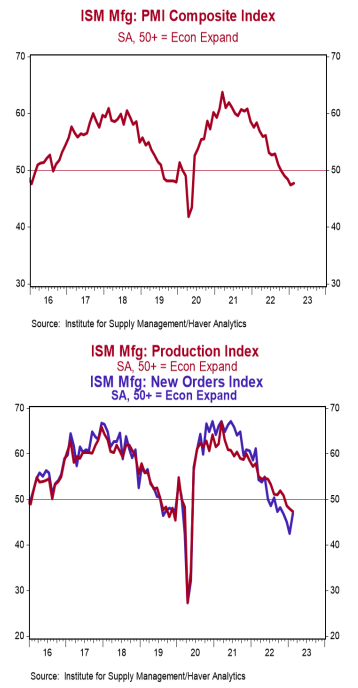

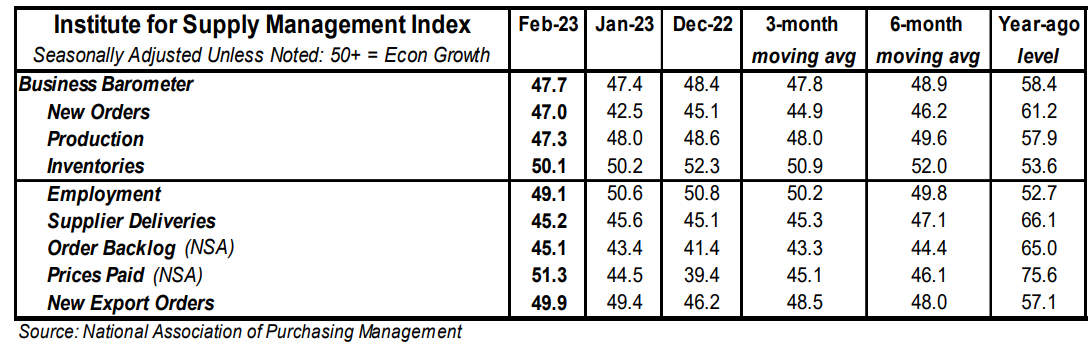

- The ISM Manufacturing Index increased to 47.7 in February, lagging the consensus expected 48.0. (Levels higher than 50 signal expansion; levels below 50 signal contraction.)

- The major measures of activity were mixed in February but all below 50, signaling contraction. The new orders index rose to 47.0 from 42.5 in January, while the production index declined to 47.3 from 48.0. The supplier deliveries index fell to 45.2 from 45.6 in January and the employment index declined to 49.1 from 50.6.

- The prices paid index rose to 51.3 in February from 44.5 in January.

Implications:

The US manufacturing sector remained in contraction territory in February with only four of eighteen industries reporting growth. The new orders index rose for the first time in four months, but still remains in contraction territory, with only three of eighteen industries reporting growth. This is not surprising given that consumers have been shifting their preferences away from goods and back toward services. However, worries about the future have now caused factories to slow down the pace of production, with that index declining further in February. Meanwhile, the employment index fell back into contraction territory in February, though sentiment still favors attempting to hire rather than reducing employment levels. The hiring to reduction ratio among panelists’ comments was 2-to-1 in February (compared to 4-to-1 in the previous month). Finally, the prices index jumped to 51.3 in February, the first time in expansion territory since September. This will be an important development to follow; a rebound in goods inflation will make it even harder for the Fed to wrestle inflation down to its 2.0% target. In other news this morning, construction spending declined 0.1% in January, with large declines in home building and commercial projects more than offsetting gains in manufacturing. On the housing front, pending home sales (contracts on existing homes) surged 8.1% in January after a 1.1% gain in December. These figures suggest existing home sales, which are counted at closing, will rise in February for the first time in more than a year. Part of the reason for a partial rebound in home sales might be continuing declines in home prices. The FHFA index, which counts homes financed with conforming mortgages, declined 0.1% in December; the national Case-Shiller index declined 0.3%. Although both these indexes were up in 2022, they were down in the second half of the year and likely to remain so until late this year. On the manufacturing front, the Richmond Fed index, a measure of mid-Atlantic factory sentiment, dropped to -16 in February from -11 in January, the lowest level since the early months of COVID. Finally, the Federal Reserve reported that the M2 measure of the money supply ticked up 0.1% in January but is down 1.7% in the last twelve months. The M2 measure of the money supply soared in the first two years of COVID, up 40.4% from February 2020 to February 2022. But in the eleven months since then, the M2 measure of money declined 2.0%. Not only have we never experienced a Fed trying to fight an inflation problem under an abundant reserve regime, we’ve never seen M2 grow so fast for so long, or decline so rapidly, at least since the Great Depression. If the recent data are accurate, the economy is in for a very rough time in 2023-24. We have already seen some weakness in production reports but are not close to feeling the full brunt of the tighter money that started last year. Investors must be cautious; a storm is headed our way.