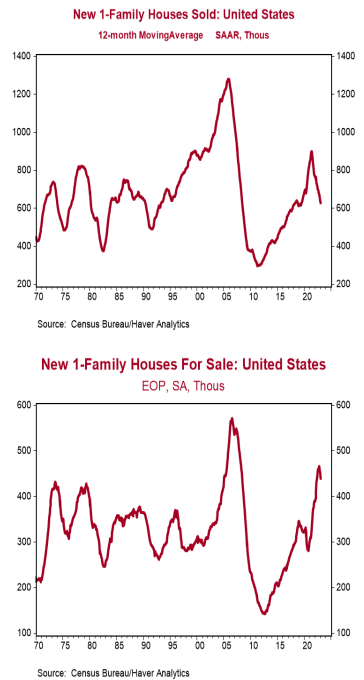

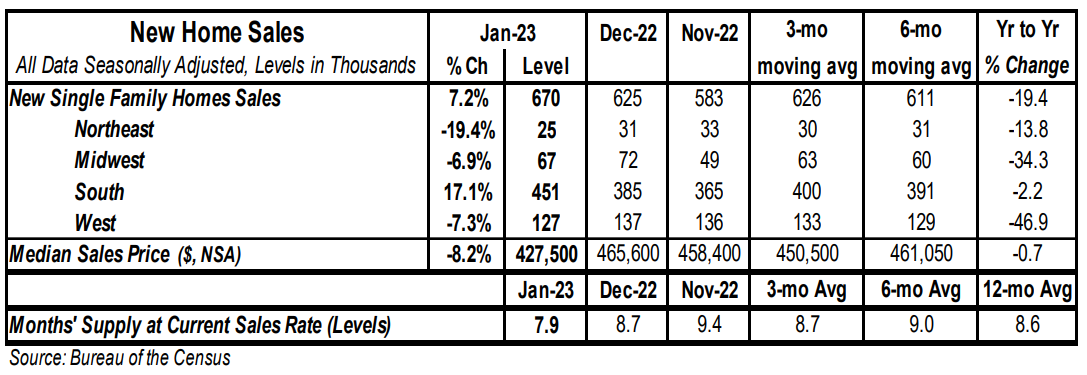

- New single-family home sales increased 7.2% in January to a 0.670 million annual rate, beating the consensus expected 0.620 million. Sales are down 19.4% from a year ago.

- Sales in January rose in the South but fell in the Northeast, West, and Midwest.

- The months’ supply of new homes (how long it would take to sell all the homes in inventory) fell to 7.9 in January from 8.7 in December. The decline was due to both a faster pace of sales and a 13,000 unit drop in inventories.

- The median price of new homes sold was $427,500 in January, down 0.7% from a year ago. The average price of new homes sold was $474,400, down 5.3% versus last year.

Implications:

New home sales started off 2023 on a healthy note, rising for the second month in a row and signaling that sales activity may have hit a temporary bottom. However, even with this modestly positive recent trend, sales are still down 19.4% in the past year. The main issue with the US housing market has been declining affordability, with potential buyers getting squeezed by both higher prices and rapidly rising mortgage rates. Assuming a 20% down payment, the change in mortgage rates and home prices in the past year amounts to a 33% increase in monthly payments on a new 30-year mortgage for the median new home. No wonder sales have slowed down! With 30-year mortgage rates currently sitting near 7.0%, financing costs remain a headwind. It’s also important to note that mortgage rates have been rising again recently so there is likely more volatility ahead for the housing market. A piece of good news is that while a lack of inventory has contributed to price gains in the past couple of years, inventories have made substantial gains versus a couple of year ago. The months’ supply of new homes (how long it would take to sell the current inventory at today’s sales pace) is now 7.9, up significantly from 3.3 early in the pandemic. Most importantly, the supply of completed single-family homes has begun to rise quite rapidly as builders finish more units and rising cancellation rates on purchases leave potential buyers with more options. Though not a recipe for a significant rebound, more inventories should help moderate home prices and put a floor under sales activity. Yes, overall inventories declined in January, but not for completed homes, which continued to rise. One problem with assessing housing activity is that the Federal Reserve held interest rates artificially low for more than a decade. With rates now in a more normal range, the sticker shock on mortgage rates for potential buyers is very real. However, we have had strong housing markets with rates at current levels in the past, and homebuyers will eventually adjust, possibly by looking at lower priced homes.