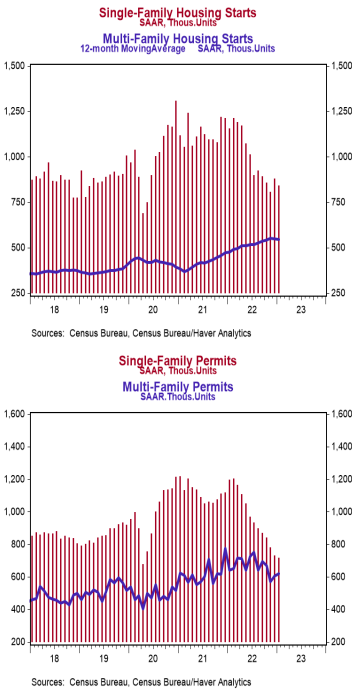

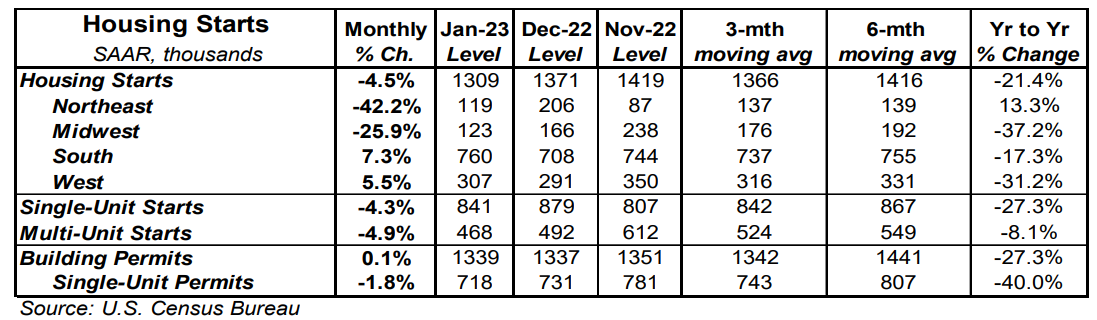

- Housing starts declined 4.5% in January to a 1.309 million annual rate, below the consensus expected 1.356 million. Starts are down 21.4% versus a year ago.

- The decline in January was due to both single-family and multi-unit starts. In the past year, single-family starts are down 27.3% while multi-unit starts are down 8.1%.

- Starts in January fell in the Northeast and Midwest but rose in the South and West.

- New building permits increased 0.1% in January to a 1.339 million annual rate, lagging the consensus expected 1.350 million. Compared to a year ago, permits for single-family homes are down 40.0% while permits for multi-unit homes are down 3.6%.

Implications:

Housing starts continued to slow in January, falling for a fifth consecutive month as builders continue to grapple with lower demand due to the surge in mortgage rates since late 2021. Notably, the drop in starts in January occurred in spite of unusually mild winter weather that is usually a temporary spur to breaking ground on new homes. Looking at the details, both single-family and multi-unit construction contributed to January’s decline. With 30-year mortgage rates rising again recently, it doesn’t look like the housing market is going to get the relief it wants on the affordability side of the picture. However, rates are still down from the recent peak and it looks like the sticker shock of the rapid run-up in financing costs last year is beginning to wear off, improving the future sales outlook from developers. In fact, yesterday’s reading on homebuilder sentiment, as measured by the NAHB Housing Index, rose to 42 in February from 35 in January. This is the second consecutive gain following the longest streak of declines since records began in 1985. That said, an index reading below 50 still signals that more builders view conditions as poor vs. good. However, these data reinforce our view that the housing market is beginning to find its footing in the new higher rate environment. Though groundbreaking on new residential projects is down 21.4% from a year ago, keep in mind that construction overall has hardly ground to a halt. Lots of projects were already in the pipeline, with the number of homes under construction hovering near the highest level on record back to 1970. These figures also demonstrate a slower construction process due to a lack of workers and other supply-chain difficulties. Given that builders already have their hands full, it wasn’t surprising to see permits for new projects remain essentially unchanged in January. Housing isn’t going to be a source of economic growth in the year ahead, but do not expect a housing bust nearly as harsh as in the 2000s. In labor market news this morning, initial unemployment claims fell 1,000 last week to 194,000, while continuing claims rose by 16,000 to 1.696 million. Finally, the Philadelphia Fed Index, which measures manufacturing sentiment in that region, fell to -24.3 in February from -8.9 in January. We believe a recession is on the horizon in 2023 with the goods sector leading the way.