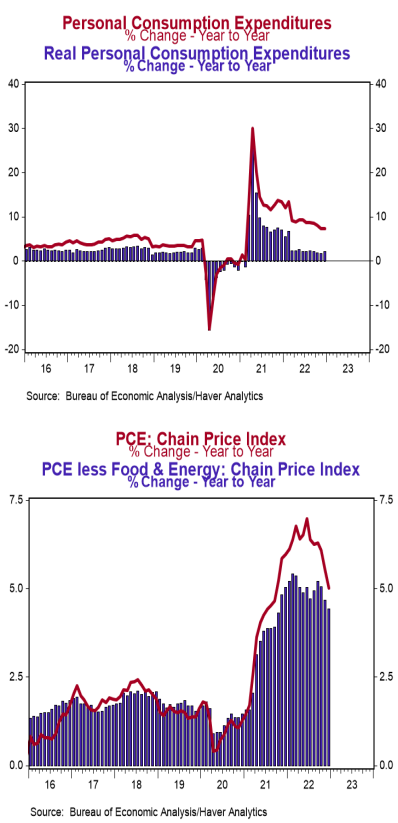

- Personal income rose 0.2% in December, matching consensus expectations. Personal consumption declined 0.2% in December (-0.5% including revisions to prior months), also matching consensus expectations. Personal income is up 4.6% in the past year, while spending has increased 7.4%.

- Disposable personal income (income after taxes) increased 0.3% in December (+0.4% including revisions) and is up 3.2% from a year ago.

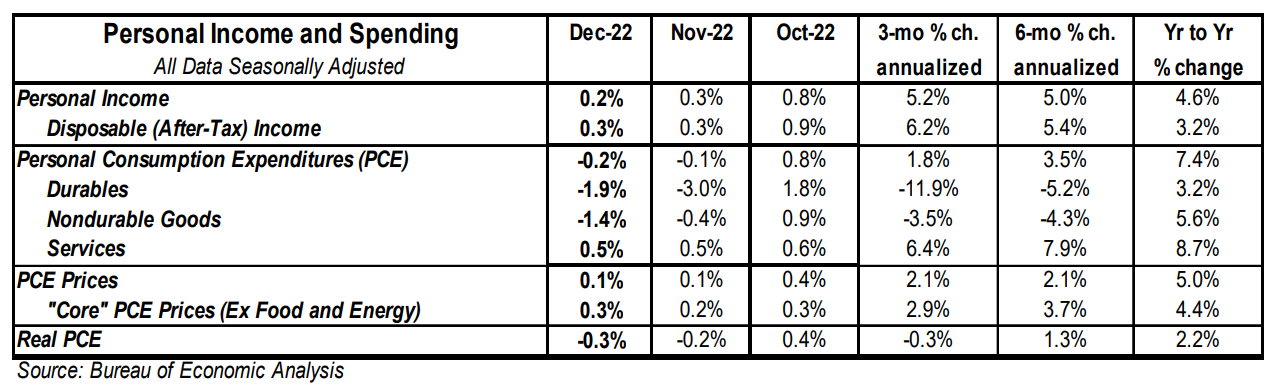

- The overall PCE deflator (consumer prices) rose 0.1% in December, and is up 5.0% versus a year ago. The “core” PCE deflator, which excludes food and energy, rose 0.3% in December and is up 4.4% in the past year.

- After adjusting for inflation, “real” consumption declined 0.3% in December (-0.6% including revisions), but is up 2.2% from a year ago.

Implications:

Incomes rose while spending fell in December, as consumers continue to fight an inflation that has eaten into their spending power. Consumer spending declined 0.2% for the month, while prices rose 0.1%, which means “real” spending (which adjusts for inflation) declined 0.3%. Before diving into the details on the income and spending side, today’s PCE price data are sure to get attention given that it’s the Fed’s preferred measure of inflation, and one of the last key pieces for data to be released before the Fed’s meeting next week. PCE prices rose 0.1% in December and are up 5.0% from a year ago, while core prices, which exclude food and energy, rose 0.3% for the month and are up 4.4% from a year ago. The Fed will welcome the slowing of overall inflation on a twelve-month basis (which was as high as 7.0% back in June), but it is far too early to revise plans for rate hikes. Core prices dipped on a twelve-month basis back in July before bouncing back above 5.0% over the following months. And while goods prices are moderating (up 4.6% from a year ago in December versus 10.6% back in June), services prices continue to accelerate with little sign of easing. Services prices were up 5.2% in 2022 versus a 4.8% gain in 2021. Speaking of services, consumer spending in December was led by a 0.5% increase in spending on services, while spending on goods fell 1.6%. This divergence between services and goods is a trend we are seeing across economic releases, and one we expect will continue. Consider for a moment that from February 2020 to December of that year, due to massive government stimulus and lockdowns, spending on goods rose by more than $300 billion, while spending on services fell by over $500 billion. This government-induced shift caused a massive reallocation of resources: employees, consumer dollars, and investment. Now, as we return to more “normal” spending patterns, the goods side of the economy will be trending slower while services continue to heal. Spending in December was supported by a 0.2% increase in incomes, led by private sector wages and salaries which rose 0.3% and are up 5.4% in the past year. The ongoing transition to paychecks – and away from stimulus checks and government transfers – is critical for sustained economic prosperity, but will be tested as the Fed’s ongoing tightening likely pushes the economy into recession. That painful process is part of the rehab necessary to mend the broken economic bones that were hidden by the morphine of stimulus