VIEW FROM THE OBSERVATION DECK

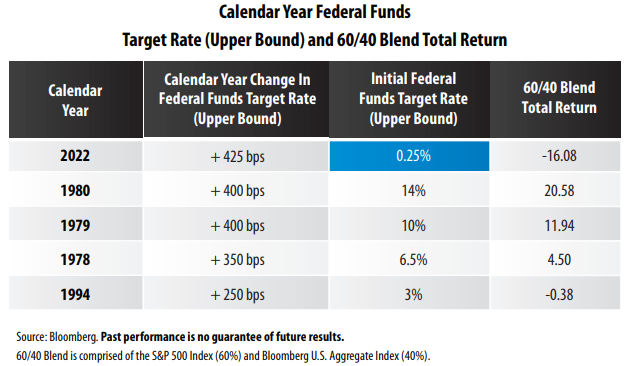

Today’s table highlights the last five times the Federal Reserve (“Fed”) increased the federal funds target rate (upper bound) by 200 basis points (bps) or more in a single calendar year. It also shows the level of the federal funds target rate at the start of the year and includes the total return of a hypothetical 60/40 blend.

The federal funds target rate at the start of 2022 was an outlier

The federal funds target rate at the start of 2022 was substantially lower than any other time period in the table. In 1979 and 1980 for example, the federal funds target rate stood at an already elevated 10% and 14%, respectively, at the start of the year. Therefore, it was much less of a shock to the financial system when the Fed raised its target rate by 400 bps in each of those years. By comparison, the 425 bps increase in the federal funds target rate in 2022 represented a seventeen-fold increase over the 0.25% where the rate stood at the start of the year.The federal funds target rate has never been this low at the start of such a steep tightening cycle.

The 60/40 portfolio has had comparatively poor returns during the current rate hike cycle

Of the five calendar years represented in the table, 2022 was the worst year for 60/40 investors. So, what changed? In each tightening cycle listed above (excluding 2022), equities significantly outperformed their fixed income counterpart. In fact, the only year the S&P 500 Index posted a negative total return for the calendar years listed was 2022 (-18.13%). The negative returns equities suffered in 2022 reflect investors’ concerns over the unprecedented surge in the federal funds target rate over the course of the year, in our opinion.