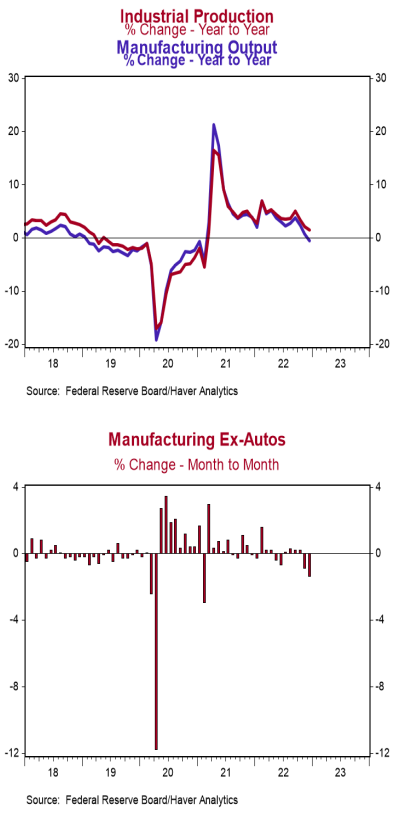

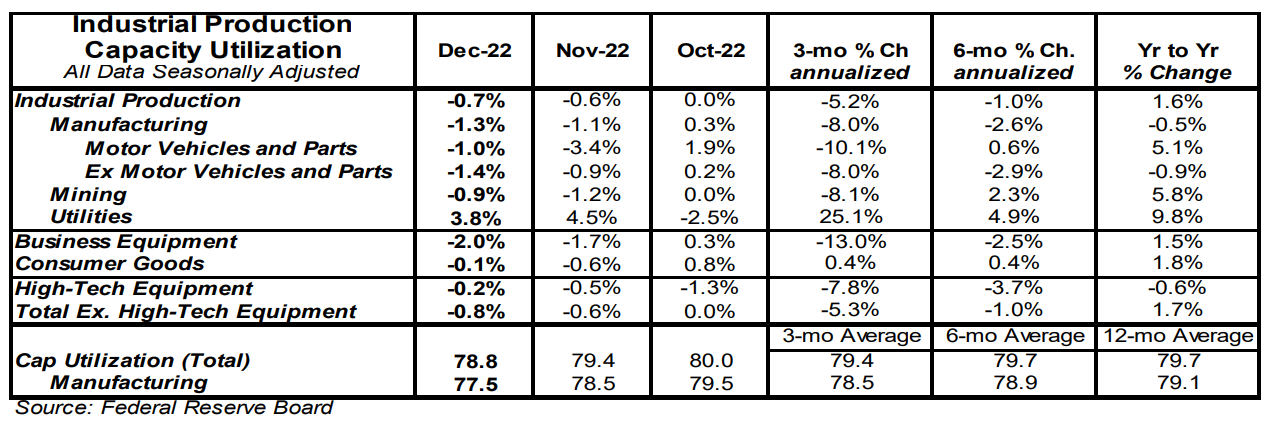

- Industrial production fell 0.7% in December (-1.0% including revisions to prior months), well below the consensus expected decline of -0.1%. Utility output rose 3.8% in December, while mining dropped 0.9%.

- Manufacturing, which excludes mining/utilities, fell 1.3% in December (-1.8% including revisions to prior months). Auto production declined 1.0%, while non-auto manufacturing fell 1.4%. Auto production is up 5.1% in the past year, while non-auto manufacturing is down 0.9%.

- The production of high-tech equipment declined 0.2% in December and is down 0.6% versus a year ago.

- Overall capacity utilization declined to 78.8% in December from 79.4% in November. Manufacturing capacity utilization fell to 77.5% in December from 78.5%.

Implications:

Today’s report on the US industrial sector was ugly, with the headline index posting the largest monthly decline in more than a year. Moreover, previous months were revised down significantly as well. Industrial production is now down 5.2% at an annualized rate in the past three months, the worst three month reading since the early days of the COVID pandemic and another signal that a recession is likely on the way in 2023. The manufacturing sector was the biggest contributor to today’s negative headline number, with production falling 1.3%. Notably, this is the largest monthly decline for the series since a severe winter vortex in 2021 knocked out utilities and froze refineries and petrochemical facilities across the country. Looking at the details, both auto and non-auto manufacturing dropped in December, posting declines of 1.0% and 1.4% respectively. Given the recent trend of American consumers shifting their preferences back toward services and away from goods, today’s weak numbers out of the manufacturing sector aren’t surprising. Another source of weakness was mining, which posted a decline of 0.9% in December. A slower pace of natural gas and other mineral extraction more than offset gains in crude oil production. It looks like oil prices, which are currently still hovering near $80 a barrel, continue to incentivize new exploration. Given that this exploration will translate into more production in the near future, the US energy sector could be a lifeline for industrial production in 2023. Finally, the one bright spot in today’s report came from the utilities sector (which is largely dependent on weather), which posted a gain of 3.8% in December. However, given (seasonally-adjusted) warmer weather in January, expect utility production to drop back down in the next report. In other recent manufacturing news, the Empire State Index, a measure of New York factory sentiment, fell to -32.9 in January from -11.2 in December. In addition, the sale of medium and heavy trucks fell 13.5% in December, the largest drop for any month since the onset of COVID. These data reinforce our view that a recession is on the way in 2023, with the goods sector leading the contraction in economic activity.