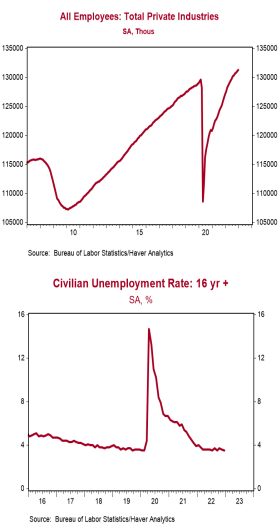

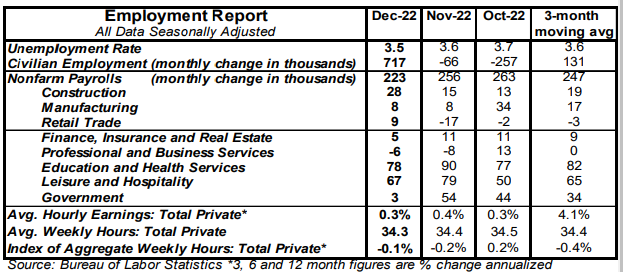

- Nonfarm payrolls increased 223,000 in December, beating the consensus expected 203,000. Payroll gains for October and November were revised down by a total of 28,000, bringing the net gain, including revisions, to 195,000.

- Private sector payrolls rose 220,000 in December but were revised down 48,000 in prior months. The largest increases in December were for health care & social assistance (+74,000), leisure & hospitality (+67,000), and construction (+28,000). Manufacturing increased 8,000 while the government rose 3,000.

- The unemployment rate declined to 3.5% from 3.6% in November.

- Average hourly earnings – cash earnings, excluding irregular bonuses/commissions and fringe benefits – rose 0.3% in December and are up 4.6% versus a year ago. Aggregate hours declined 0.1% in December but are up 1.9% from a year ago.

Implications:

On the surface, the job market looks good. But the details of today’s report warn of trouble ahead. First the good news. Nonfarm payrolls rose 223,000 in December, beating the consensus expected 203,000 and ending the year with a total gain of 4.5 million. Meanwhile, civilian employment, an alternative (although more volatile) measure of jobs that includes small-business start-ups, rose 717,000 in December, ending the calendar year with a total gain of 3.2 million. In addition, the labor force (workers and those looking for work) grew 439,000 in December, ending the year with a total gain of 2.6 million. Put it all together and we finished the year with an unemployment rate at 3.5%, tying the low so far for the recovery from COVID. But here’s why today’s report signals some trouble ahead. Temporary help service jobs (temps) fell 35,000 in December, the fifth straight monthly decline, to a level below a year ago. Consistent declines in temp jobs usually happen late in a business cycle. And although jobs increased in December, the total number of hours worked did not. Total hours ticked down 0.1% for the month, the second consecutive decline. The loss of hours in December was the equivalent to losing about 125,000 jobs. Another way of thinking about it is that many employers were still hiring, but workers didn’t have as much to do. That’s not sustainable. Some “bond market vigilantes” were happy that average hourly wages rose a moderate 0.3% in December, while the year ago comparison slowed to a gain of 4.6% (versus 5.6% back in March). They think this means the Federal Reserve has less work to do. But the “core” CPI (excluding food and energy) is likely up about 5.9% in the past year, which suggests the Fed will keep raising short-term rates in the months ahead. The slowdown in wage growth also spells trouble for workers’ purchasing power. Combining wages and hours worked, total private-sector wages are up 6.6% from a year ago, roughly the same as overall consumer prices…and that’s with 4.5 million more workers! Bottom-line: beneath the good headlines, the job market is getting weaker, but the not weak enough to stop the Fed from raising rates further in the months ahead.