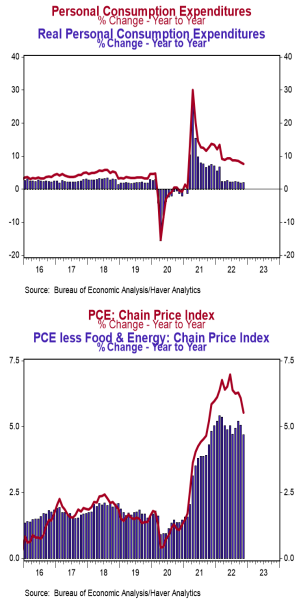

- Personal income rose 0.4% in November (+0.3% including revisions to prior months) versus a consensus expected +0.3%. Personal consumption increased 0.1% in November (+0.3% including revisions) versus a consensus expected +0.2%. Personal income is up 4.7% in the past year, while spending has increased 7.7%.

- Disposable personal income (income after taxes) increased 0.4% in November (+0.5% including revisions) and is up 2.9% from a year ago.

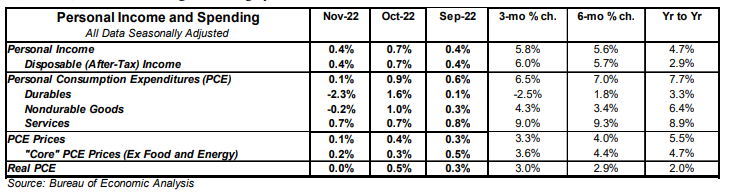

- The overall PCE deflator (consumer prices) rose 0.1% in November, and is up 5.5% versus a year ago. The “core” PCE deflator, which excludes food and energy, rose 0.2% in November and is up 4.7% in the past year.

- After adjusting for inflation, “real” consumption was unchanged in November (+0.1% including revisions), but is up 2.0% from a year ago.

Implications:

Growth in consumer spending slowed in November following hot readings in each of the prior three months. Overall consumer spending rose 0.1% for the month, matching the 0.1% gain in consumer prices, which means consumers spent just enough to keep up with the pace of inflation. Before diving into the details on the income and spending side, today’s PCE price data are sure to get the attention given that it’s the Fed’s preferred measure of inflation. PCE prices rose 0.1% in November and are up 5.5% from a year ago. Core prices, which exclude food and energy, rose 0.2% in November and are up 4.7% from a year ago. While the Fed will welcome the slowing of inflation on a twelve-month basis, it is far too early to revise plans for rate hikes in the year ahead. Core prices dipped to 4.7% on a twelve-month basis back in July before bouncing back above 5.0% over the following months. And while goods prices are moderating (up 6.1% from a year ago in November versus 10.6% in June), services prices continue to accelerate with little sign of easing. Speaking of services, consumer spending in November was led by a 0.7% increase in spending on services, while spending on goods fell 1.0%. This divergence between services and goods is a trend we expect will continue. Consider for a moment that from February 2020 to December of that year, due to massive government stimulus and lockdowns, spending on goods rose by more than $300 billion, while spending on services fell by over $500 billion. This government-induced shift caused a massive reallocation of resources: employees, consumer dollars, and investment. Now, as we return to more “normal” spending patterns, the goods side of the economy will be trending slower while services continue to heal. Spending in November was supported by a 0.4% increase in incomes, led by private sector wages and salaries which rose 0.5% are up 6.5% in the past year. In other news from this morning, durable goods orders fell 2.1% in November (-2.4% including revisions to prior months) as commercial aircraft orders plummeted 36.4% from October levels. Excluding transportation, durable goods order rose 0.2% in November and are up 3.4% in the past year. One of the most important pieces of today’s report, shipments of “core” non-defense capital goods ex-aircraft (a key input for business investment in the calculation of GDP), declined 0.1% in November. If unchanged in December, these orders would be up at a 5.7% annualized in Q4 versus the Q3 average, providing a tailwind for fourth-quarter GDP, which, for now, looks to be coming in at a roughly 1.5% annual rate.