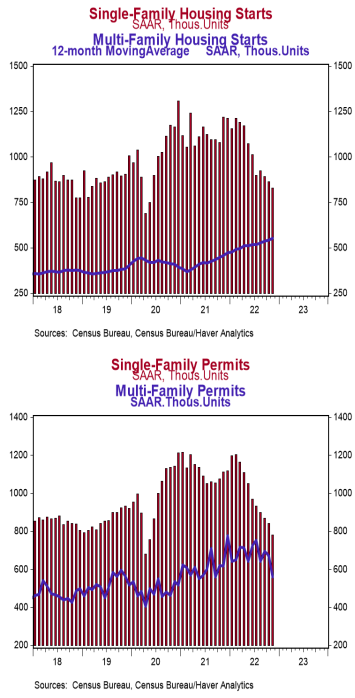

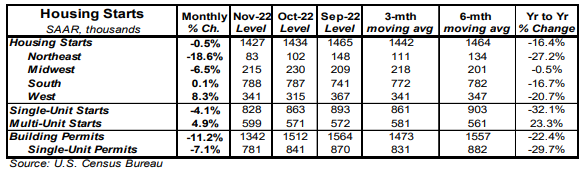

- Housing starts declined 0.5% in November to a 1.427 million annual rate, beating the consensus expected 1.400 million. Starts are down 16.4% versus a year ago.

- The decline in November was due to single-family starts. Multi-unit starts rose in November. In the past year, single-family starts are down 32.1% while multi-unit starts are up 23.3%.

- Starts in November fell in the Northeast and Midwest but rose in the West and South.

- New building permits fell 11.2% in November to a 1.342 million annual rate, lagging the consensus expected 1.480 million. Compared to a year ago, permits for single-family homes are down 29.7% while permits for multi-unit homes are up 9.2%.

Implications:

If you think Fed tightening only “destroys demand” you are missing the supply side of the equation. Housing starts continued to slow in November as relatively high mortgage rates and ongoing supply-chain issues continue to weigh on builders. Looking at the details, a gain in multi-unit construction was outweighed by a continued decline in single-family projects, which pulled the headline number into negative territory. It is clear developers have become more cautious about future demand for new single-family projects with 30-year mortgage rates near 6.5%. Instead, they are focusing on apartment buildings. Over the past year single-family starts are down 32.1%, a sharp contrast to multi-unit starts which are up 23.3%. Though groundbreaking on new residential projects is now down 20.9% from the peak earlier this year, keep in mind that construction overall has hardly ground to a halt. Lots of projects are already in the pipeline, with the number of homes under construction at the highest level on record back to 1970. These figures demonstrate a slower construction process due to a lack of workers and other supply-chain difficulties. Given that builders already have their hands full, it wasn’t surprising to see permits for new projects fall 11.2% in November. Notably the decline in permits was largely driven by multi-unit projects. Looking at the backlog of construction — homes that have been authorized but not yet started — shows that multi-unit projects now outnumber single-family units in the pipeline of future activity. In other recent housing news, homebuilder sentiment, as measured by the NAHB Housing Index, continues to deteriorate. The index fell for a twelfth consecutive month to 31 in December, the longest streak of declines on record. An index reading below 50 signals that more builders view conditions as poor vs. good. The prime concern continues to be higher mortgage rates, which are having a negative impact on potential sales as certain buyers are at least temporarily priced out of the market, leaving some builders with a surplus of inventory. Housing isn’t going to be a source of economic growth in the year ahead, but do not expect a housing bust nearly as harsh as in the 2000s. Unlike the previous housing bust, we do not have a massive oversupply of homes and those who locked-in fixed-rate mortgages before this year will hold their homes dear.