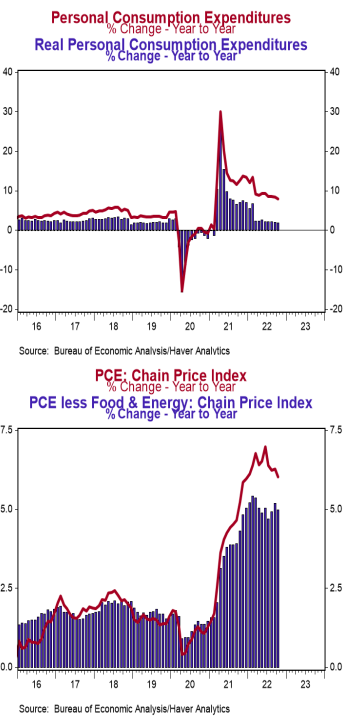

- Personal income rose 0.7% in October (+0.5% including revisions to prior months), beating the consensus expected +0.4%. Personal consumption increased 0.8% in October (+1.0% including revisions), matching consensus expectations. Personal income is up 4.9% in the past year, while spending has increased 7.9%.

- Disposable personal income (income after taxes) increased 0.7% in October (+0.2% including revisions) and is up 2.8% from a year ago.

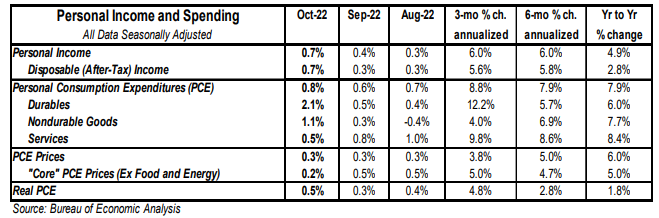

- The overall PCE deflator (consumer prices) rose 0.3% in October, and is up 6.0% versus a year ago. The “core” PCE deflator, which excludes food and energy, rose 0.2% in October and is up 5.0% in the past year.

- After adjusting for inflation, “real” consumption rose 0.5% in October (+0.6% including revisions), and is up 1.8% from a year ago.

Implications:

Consumer spending surged in October, but don’t expect that to last. Overall consumer spending rose 0.8% for the month, beating the 0.3% gain in consumer prices, which means consumers were spending more on a “real” (inflation-adjusted basis), as well. The surge in spending in October was led by a 1.4% increase in spending on consumer goods, which is part of the reason why we think growth in consumer spending will be much slower in the months ahead. Consider for a moment that from February 2020 to December of that year, due to massive government stimulus, spending on goods rose by more than $300 billion, while spending on services fell by over $500 billion. This government-induced shift caused a massive reallocation of resources: employees, consumer dollars, and investment. Now, as we return to more “normal” spending patterns, the goods side of the economy will be trending slower while services continue to heal. Meanwhile, incomes rose 0.7%, as wages and salaries grew, but incomes were also boosted by government benefits related to one-time refundable tax credits paid out by states. PCE prices – the Fed’s preferred measure of inflation – rose 0.3% in October and are up 6.0% from a year ago. Core prices, which exclude food and energy, rose 0.2% in October and are up 5.0% from a year ago. The Fed may very well slow the pace of rate hikes starting with their meetings in two weeks, but they are likely to have to ultimately raise rates higher – and for longer – than they currently anticipate in order to get inflation in check. And while we are not in a recession yet, the Fed is very likely to cause one as they try to undo the effects of the policy decisions made over the last two and a half years. In other news from this morning, initial unemployment claims fell 15,000 last week to 225,000; continuing claims rose 57,000 to 1.608 million. We expect tomorrow’s employment report to show a nonfarm payroll gain of 183,000. On the housing front, pending home sales, which are contracts on existing homes, declined 4.6% in October after a large drop in September, as well, suggesting another month of weak existing home sales in November.