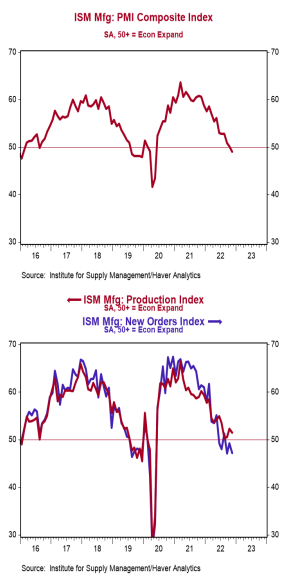

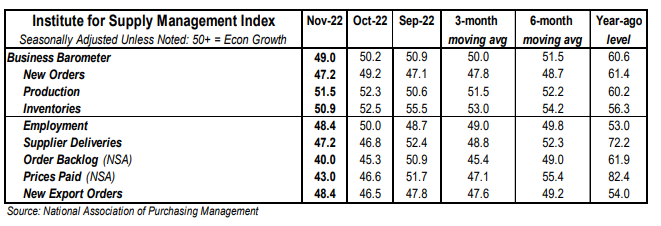

- The ISM Manufacturing Index declined to 49.0 in November, lagging the consensus expected 49.7. (Levels higher than 50 signal expansion; levels below 50 signal contraction.)

- The major measures of activity were mostly lower in November. The production index fell to 51.5 from 52.3 in October, while the new orders index fell to 47.2 from 49.2. The supplier deliveries index increased to 47.2 from 46.8 in October and the employment index fell to 48.4 from 50.0.

- The prices paid index declined to 43.0 in November from 46.6 in October.

Implications:

The US manufacturing sector officially entered contraction territory in November, at least in terms of sentiment, with only six of eighteen industries reporting growth. Respondent comments in November were mainly focused on worries about the pace of future activity with some customers pulling back on new orders due to worries about an economic slowdown, especially in the European Union. However, what was most notable about today’s survey responses was what wasn’t said. Specifically, the lack of comments related to the supply-chain issues that have plagued the manufacturing sector over the past few years. This was reflected in the details in today’s report, as well. New orders fell further into contraction territory in November, which is hardly surprising given that consumers have been shifting their preferences away from goods and back toward services. However, despite declining in today’s report, the production index remains in expansion. This is giving US factories time to catch up on all the existing orders they already have in the pipeline. The result is the first reduction in supply-chain pressures in years. For example, the index for order backlogs fell to 40.0 in November, the lowest reading since the early days of the COVID pandemic. Meanwhile, the supplier deliveries index remained in negative territory at 47.2 as well. This means supply-chain problems aren’t just getting worse at a slower rate, they are finally reversing. Meanwhile the employment index fell to 48.4 in November. While panelists in recent months have said they are beginning to take a pause on new hiring and allowing labor turnover to reduce headcount, layoffs also began to be mentioned in November. This is a sign that a weaker outlook for new orders may finally be hurting demand for labor in the US factory sector. Finally, the prices index in today’s report continued to signal that inflation pressures have likely peaked in the goods sector, falling for the eighth month in a row to 43.0. While lower prices for goods will help moderate overall inflation, we expect that the services sector will now be the main driver going forward, keeping inflation well above the Fed’s 2% target. In other news this morning, construction spending fell 0.3% in October, with large declines in manufacturing facilities and home building more than offsetting gains in power projects and recreational facilities.