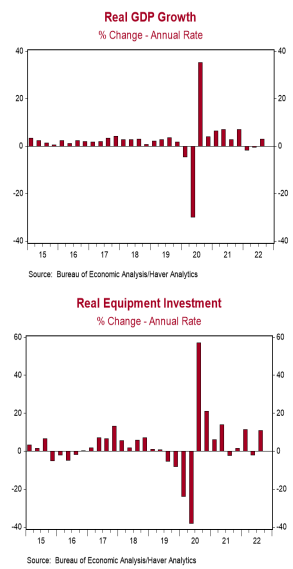

- Real GDP growth in Q3 was revised higher to a 2.9% annual rate from a prior estimate of 2.6%, narrowly beating the consensus expected revision to 2.8%.

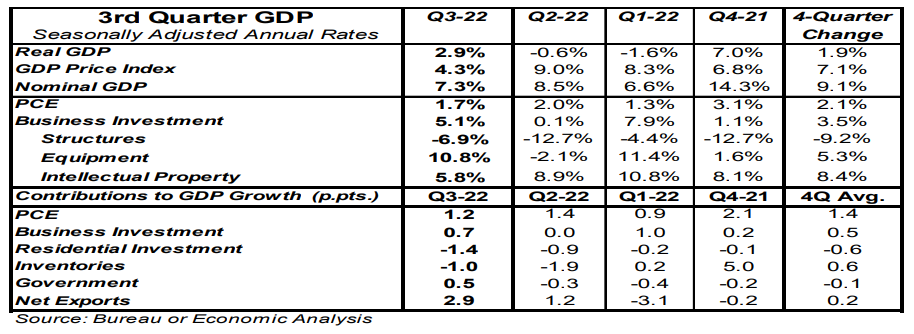

- Upward revisions to consumer spending, business investment, government purchases, and net exports more than offset a downward revision to inventories.

- The largest positive contributions to the real GDP growth rate in Q3 were net exports and consumer spending. The weakest components were home building and inventories.

- The GDP price index was revised up to a 4.3% annual growth rate from a prior estimate of 4.1%. Nominal GDP growth – real GDP plus inflation – was revised up to a 7.3% annualized rate from a prior estimate of 6.7%.

Implications:

Today’s second report on third quarter real GDP was revised higher from the initial reading a month ago, growing at a 2.9% annual rate. The upward revision to the overall number was due to stronger consumer spending, business investment, net exports, and government purchases, which more than offset a downward revision to inventories. Today we also received our first look at corporate profits for the third quarter, which declined 1.1% versus Q2, but are still up 4.4% from a year ago. Profits in Q3 declined at domestic financial companies as well as from operations abroad, while rising at domestic non-financial corporations. Moving forward, we expect further declines in corporate profits as the economy continues to re-normalize after the massive fiscal and monetary stimulus of 2020-21. In turn, this will be a headwind for equities similar to the headwinds this year due to rising interest rates. Regarding monetary policy, today’s inflation news shows the Federal Reserve has more work to do. GDP inflation was revised higher to an 4.3% annual rate in Q3 versus a prior estimate of 4.1%. GDP prices are up 7.1% from a year ago, nowhere near the Fed’s 2.0% target. Meanwhile, nominal GDP (real GDP growth plus inflation) rose at an 7.3% annual rate in Q3 and is up 9.1% from a year ago. In other news today, the ADP employment report showed a gain of 127,000 private-sector jobs in November. After plugging this into our model, we expect Friday’s employment report to show a nonfarm payroll gain of 183,000. On the housing front, national price measures were mixed in September. The FHFA index, which tracks homes financed by conforming mortgages, ticked up 0.1% in September after declines in July and August. The FHFA index is still up 11.0% from a year ago. The Case-Shiller index fell 0.8% in September and is up 10.6% from a year ago. The largest declines in the past three months have been in San Francisco, Seattle, and San Diego, with Miami as the only major metro area with a net gain since June. Our forecast is that these national indexes will generally decline in the year ahead, but that the overall drop in national average prices from peak to bottom will be in the range of 5 - 10%, not the 25% debacle in the previous housing bust. Why? Because home prices are not far out of line with construction costs, we didn’t have massive overbuilding, and the low mortgage rates prior to 2022 will keep many existing homeowners from selling their homes.