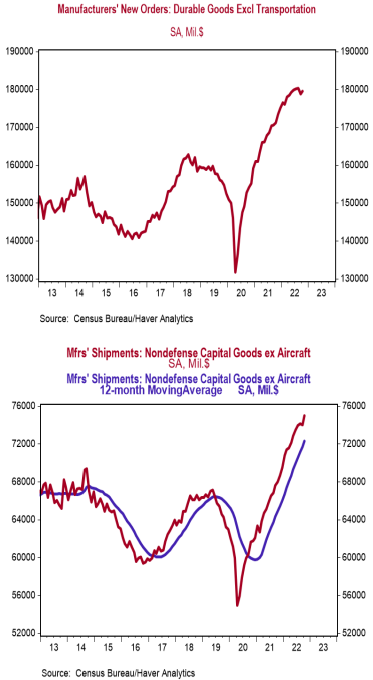

- New orders for durable goods rose 1.0% in October (+0.9% including revisions to prior months), beating the consensus expected +0.4%. Orders excluding transportation rose 0.5% in October (+0.1% including revisions), beating the consensus expectation of no change. Orders are up 10.7% from a year ago, while orders excluding transportation are up 4.9%.

- A surge in orders for commercial aircraft and machinery in October led gains across nearly all major categories.

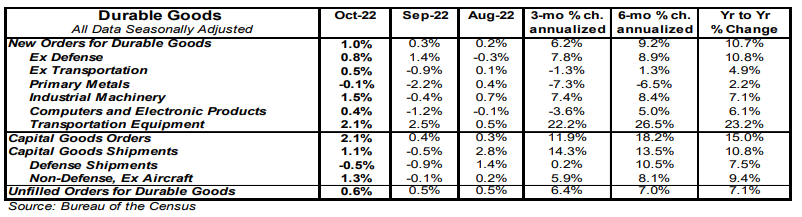

- The government calculates business investment for GDP purposes by using shipments of non-defense capital goods excluding aircraft. That measure rose 1.3% in October. If unchanged in November and December, these orders would be up at a 5.4% annualized rate in Q4 versus the Q3 average.

- Unfilled orders rose 0.6% in October and are up 7.1% in the past year.

Implications:

Today’s report on durable goods orders gives plenty to be thankful for heading into tomorrow’s holiday, as orders rose virtually across the board and well exceeded consensus estimates. The largest rise in October came from commercial aircraft orders, which rose 7.4% following a massive 23.4% jump in September. But even stripping out the typically volatile transportation components, orders still rose a healthy 0.5% in October, beating the consensus expectation for a flat reading. Nearly every major non-transportation category of orders rose in October, with the primary metal category’s slight decline the lone exception. Machinery orders, which were weak in September, roared back in October with a 1.5% gain. One of the most important pieces of today’s report, shipments of “core” non-defense capital goods ex-aircraft (a key input for business investment in the calculation of GDP), increased 1.3% in October following a healthy third quarter. If unchanged in November and December, these orders would be up at a 5.4% annualized in Q4 versus the Q3 average, providing a tailwind for fourth-quarter GDP. Orders for core capital goods (which will lead to shipments in the future), likewise showed strength in October, rising 2.1 %. While we welcome the recent strength in orders, we are cautious on what the next twelve months will bring. The shift from services to goods accelerated overall durable goods purchases beyond where they would have been had COVID never happened. The return toward services means a large portion of goods-related activity will soften in the year ahead, even as some durables that facilitate services (like airplanes) recover. In other recent news the Federal Reserve reported that the M2 measure of the money supply declined 0.4% in October, the third decline for M2 in as many months. The M2 money supply soared 40.3% in 2020-21, the largest increase for any two years on record, but, so far this year, has declined at a 0.4% annual rate. If these recent data are accurate (we have some doubt) and if this slow pace continues for a prolonged period, the economy is in for a very rough time in 2023-24 and inflation, which should remain elevated in 2023, could plummet in 2024. In other news from this morning, initial unemployment claims rose 17,000 last week to 240,000; continuing claims rose 48,000 to 1.551 million. These figures are consistent with rising payrolls in November, but not nearly as fast as earlier this year. On the manufacturing front, the Richmond Fed index, a measure of mid-Atlantic factory sentiment, rose to -9 in November from -10 in October. At present, we are estimating a 49.9 reading on the national ISM index reported next week, which would be the first sub-50 report since early 2020 during the onset of COVID-related shutdowns.