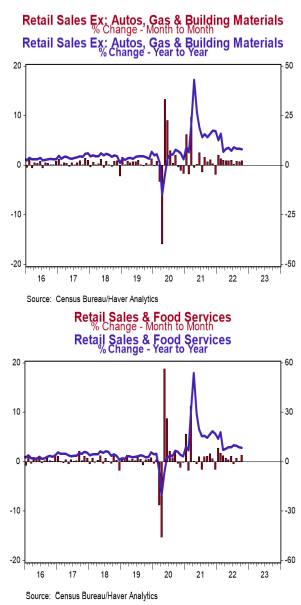

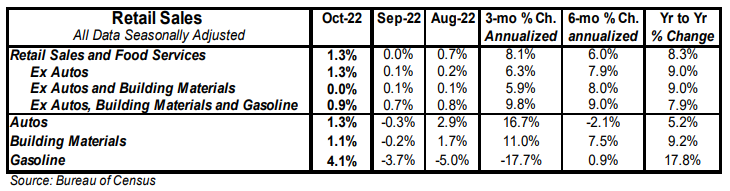

- Retail sales rose 1.3% in October (+1.5% including revisions to prior months), beating the consensus expected gain of 1.0%. Retail sales are up 8.3% versus a year ago.

- Sales excluding autos rose 1.3% in October (+1.6% including revisions to prior months), easily beating the consensus expected 0.5% gain. These sales are up 9.0% in the past year. Excluding gas, sales rose 1.0% in October and are up 7.4% from a year ago.

- The largest gains in October were for gas stations, autos, and restaurants & bars. The largest decline was at general merchandise stores.

- Sales excluding autos, building materials, and gas rose 0.9% in October, and including prior months’ revisions were up 1.4%. If unchanged in November and December, these sales would be up at a 6.5% annual rate in Q4 versus the Q3 average.

Implications:

Another report showing the US is not yet in a recession. Retail sales boomed in October, rising 1.3%, increasing by the most in eight months, with upward revisions to prior months, as well. Nine of thirteen retail categories grew in October, led by sales at gas stations and autos, rising 4.1% and 1.3%, respectively. However, we don’t expect gains of this size to continue. Much of the increase at gas stations was due to higher prices at the pump, while some of the increase for autos was due to the replacement of storm-damaged cars. Perhaps the best news in the report was that “core” sales, which exclude the most volatile categories of autos, building materials, and gas stations, rose a strong 0.9% in October and was revised higher for prior months. These sales are up 7.9% from a year ago. The problem is that one of the key drivers of overall spending is inflation. Yes, consumers are spending more, but they are not taking home the same amount of goods. Although overall retail sales are up 8.3% from a year ago, that pace is just barely outpacing inflation, with the CPI up 7.7% over the same period. Due to very loose monetary policy and the massive increase in government transfer payments in response to COVID, retail sales are still running higher than they would have had COVID never happened. However, loose monetary policy, which helped finance that big increase in government spending, is translating into high inflation, which is why “real” (inflation-adjusted) retail sales are just slightly higher versus a year ago. This doesn’t mean overall consumer spending is down; “real” (inflation-adjusted) spending on goods and services is still rising. But it does mean overall real consumer spending growth is softer than the headlines suggest. What to expect in the months ahead? Retail sales will struggle to keep pace with inflation while overall consumer spending increases modestly due to the service sector, as consumers shift their preferences away from goods and back to services. Ultimately what the data show is that the Federal Reserve needs to stay the course and continue to tighten monetary policy. In other news this morning, import prices declined 0.2% in October while export prices fell 0.3%. Still, in the past year, import prices are up 4.2%, while export prices are up 6.9%.