View from the Observation Deck

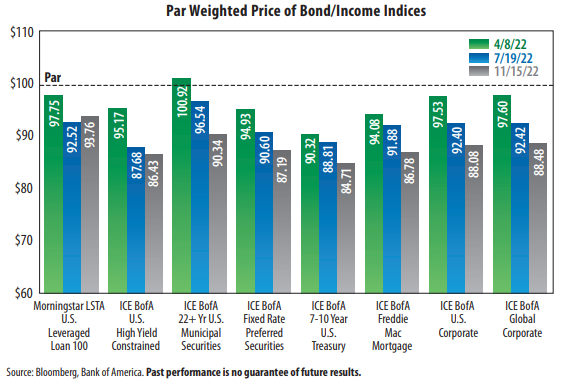

1. Today's blog post is one we do ongoing so that investors can monitor fluctuations in bond prices relative to changes in interest rates. The dates in the chart are from prior posts.

2. The Federal Reserve's ("Fed") federal funds target rate (upper bound) stood at 4.00% on 11/15/22, according to data from the Fed. Due to October’s better-than expected inflation report, many are anticipating just a 50 basis point increase in the benchmark lending rate when the Fed meets again in December (13-14), according to The Wall Street Journal.

3. For the 30-year period ended 11/15/22, the federal funds target rate (upper bound) averaged 2.46%, according to Bloomberg. It reached as high as 6.50% in May 2000.

4. The yield on the benchmark 10-year Treasury note (T-note) stood at 3.77% on 11/15/22, up from 2.71% on 4/8/22, according to Bloomberg. Its average yield was 3.91% for the 30-year period ended 11/15/22.

5. For comparative purposes, here were the closing yields for the indices featured in the chart as of 11/15/22: 8.56% (U.S. Leveraged Loan 100); 8.80% (U.S. High Yield Constrained); 4.82% (22+ Yr. Municipal Securities); 7.09% (Fixed Rate Preferred Securities); 3.76% (7-10 Yr. U.S. Treasury); 4.52% (Freddie Mac Mortgage); 5.58% (U.S. Corporate ); and 5.15% (Global Corporate), according to Bloomberg.

6. All of the major debt categories in the chart are down significantly since 4/8/22 and all of the categories are currently priced at a discount to par value.

7. The trailing 12-month rate on the Consumer Price Index stood at 7.7% in October 2022, according to the Bureau of Labor Statistics. That is up from its 6.2% reading in October 2021 and significantly higher than its 2.5% average rate over the past 30 years.

8. The yield on the 10-year T-note has topped the 3.00% mark in two previous years (2013 & 2018) over the past decade, but not for long. Will this time be different?

Stay tuned!