View from the Observation Deck

1. The benchmark 10-yearTreasury Note (T-note) hit an all-time closing low of 0.51% on 8/4/20, according to Bloomberg.

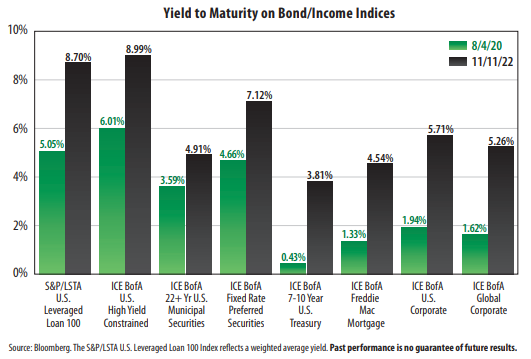

2. From 8/4/20-11/11/22, the yield on the 10-year T-note surged from 0.51% to 3.81%, or an increase of 330 basis points. During the period, its yield climbed as high as 4.24% on 10/24/22.

3. Keep in mind, while the markets are currently laser focused on the Federal Reserve's ("Fed") tightening of monetary policy, the Fed did not begin hiking interest rates until March 2022. Since then, the Fed has raised the federal funds target rate (upper bound) by 375 basis points, from 0.25% to 4.00%.The pace of rate hikes has been aggressive, with the federal funds target rate (upper bound) increasing 45 basis points more than the 330 basis point move in the 10-year T-note since 8/4/20.

4. For the 30-year period ended 11/11/22, the federal funds target rate (upper bound) averaged 2.46%, 154 basis points below the 4.00% current target rate, according to Bloomberg.

5. Investors should expect more rate hikes. The Fed looks poised to increase rates by 50 basis points at their December meeting based off recent inflation data, according to The Wall Street Journal. Fed Chairman Jerome Powell recently stated that the terminal rate (the ultimate rate the Fed is targeting) is likely to be higher than initial expectations, suggesting the terminal rate could be over 5.00%.

6. The trailing 12-month Consumer Price Index (CPI) rate stood at 7.7% in October 2022, significantly higher than its 1.2% reading in October 2020 and its 2.5% average rate for the 30-year period ended 10/31/22, according to the Bureau of Labor Statistics. Robust inflation (CPI) is the primary catalyst behind the surge in interest rates and bond yields, in our opinion.

7. We intend to monitor bond yields moving forward. Current levels are clearly more attractive than where they sat two years ago and they could go higher in the months ahead.