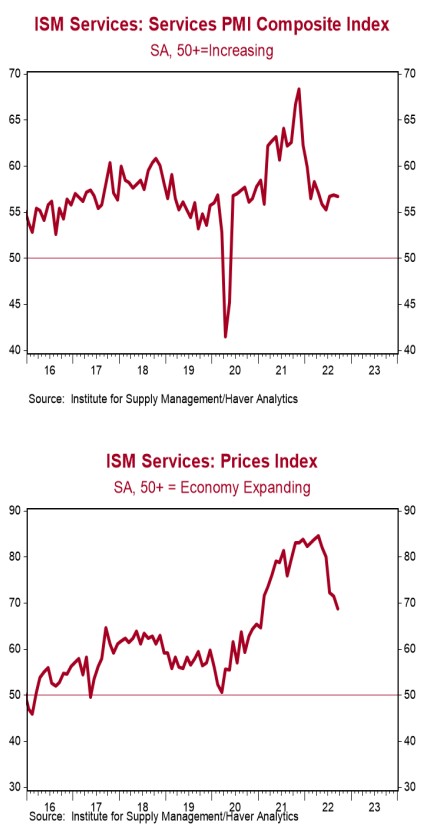

- The ISM Non-Manufacturing index declined to 54.4 in October, below the consensus expected 55.3. (Levels above 50 signal expansion; levels below signal contraction.)

- The major measures of activity moved mostly lower in October, but nearly all stand above 50, signaling growth. The new orders index declined to 56.5 from 60.6, while the business activity index dropped to 55.7 from 59.1. The employment index declined to 49.1 from 53.0, while the supplier deliveries index rose to 56.2 from 53.9.

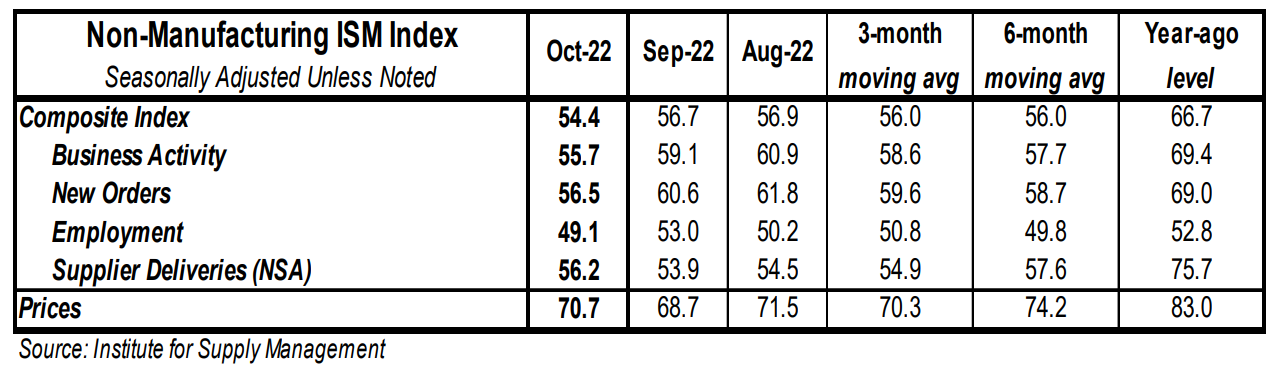

- The prices paid index increased to 70.7 in October from 68.7 in September.

Implications:

The services sector continued to expand in October, but at a slower rate than the previous month, with sixteen out of eighteen industries reporting growth. Respondent comments cited resilient sales despite being partially held back by an uncertain economic environment surrounding concerns of a future recession. Business activity and new orders – the two most forward-looking pieces of the report – both declined in October but remain comfortably in expansion territory. Contrast this with the forward-looking categories in the ISM Manufacturing report from earlier this week and it’s clear that businesses and consumers are continuing to shift resources away from goods and toward the still re-opening services sector. Keep in mind that pre-pandemic, services made up roughly 69% of consumption spending. That number fell to 65% during the depths of the pandemic as people stopped going to concerts, movies, restaurants, etc. Gross Domestic Product data from Q3 show that number has risen to 66%. Expect to see continued growth in the service sector in the months ahead as spending continues to shift back to the pre-pandemic status quo, which should ultimately lead the US economy higher in 2022. A deeper dive into the details of the report gives evidence that the service sector would be doing even better were it not for issues still lingering in the wake of poor pandemic-related policy decisions. The employment index fell back into contraction territory after expanding the previous two months. Respondent comments show that a lack of supply is what’s holding the employment index from moving higher, not demand. Meanwhile, the supplier deliveries index creeped up to 56.2, signaling that companies are still dealing with increasingly longer wait times due to supply chain problems. Finally, the prices paid index rose for the first time in six months to a historically elevated 70.7. It’s clear that inflation is still a major problem for businesses, as seventeen service industries reported paying higher prices in October, with the only industry reporting a decrease coming from wholesale trade. Despite these problems, the service sector remains strong, and we expect it will continue to be a source of strength as we close out 2022.