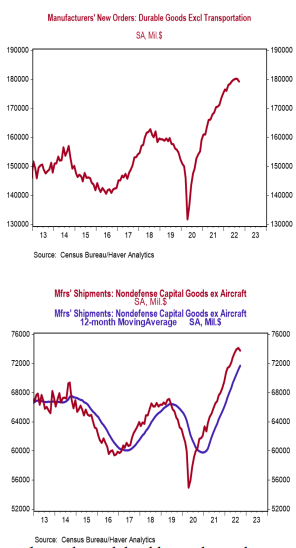

- New orders for durable goods rose 0.4% in September (+0.7% including revisions to prior months), coming in below the consensus expected +0.6%. Orders excluding transportation declined 0.5% in September (-0.8% including revisions), falling well short of the consensus expected +0.2%. Orders are up 11.3% from a year ago, while orders excluding transportation are up 5.1%.

- A surge in orders for commercial aircraft and autos in September was partially offset by declining orders for defense aircraft, primary metals, and electrical equipment.

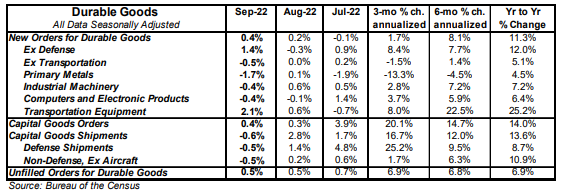

- The government calculates business investment for GDP purposes by using shipments of non-defense capital goods excluding aircraft. That measure declined 0.5% in September, but was up at a 6.3% annualized rate in Q3 versus the Q2 average.

- Unfilled orders rose 0.5% in September and are up 6.9% in the past year.

Implications:

A disappointing report on durable goods orders in September, as the transportation sector overshadowed what was otherwise weakness across the board. Far and away the largest impact on September durable goods came from the typically volatile categories of commercial aircraft and autos, where orders rose 21.9% and 2.2%, respectively. Strip out transportation, though, and orders declined 0.5% in September, coming in below the consensus expected +0.2%. Every major non-transportation category of orders fell in September. One of the most important pieces of today’s report, shipments of “core” non-defense capital goods ex-aircraft (a key input for business investment in the calculation of GDP), fell 0.5% in September after healthy gains in July and August. However, these orders grew 6.3% at an annualized rate in Q3 versus the Q2 average, providing a tailwind for third-quarter GDP (for analysis of that report out this morning, click here). However, orders for core capital goods (which will lead to shipments in the future), declined 0.7% in September, only the second monthly decline for the category in 2022. Orders for durable goods have recovered sharply since the pandemic, up 72.6% from the April 2020 bottom and now sit 18.7% above pre-pandemic levels. The shift from services to goods accelerated durable goods purchases beyond where they would have been had COVID never happened, and the return toward services taking place today means activity in the goods sector will likely soften in the year ahead.