View from the Observation Deck

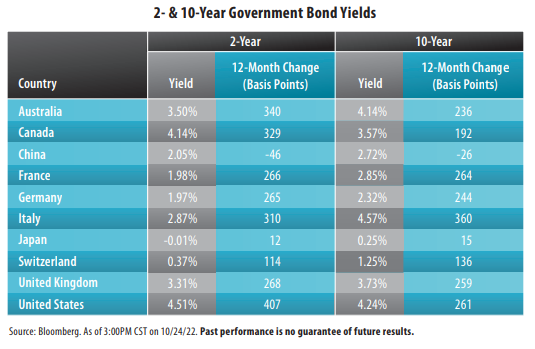

1. Today's blog post shows the yields on a couple of benchmark government bond maturities from key countries/economies around the globe.

2. In most cases, bond yields are up huge from their historic lows and it looks like they have the potential to trend higher based on recent guidance from Federal Reserve (“Fed”).

3. The yield on the U.S. 10-year Treasury Note (T-note) stood at 4.24% as of 3:00PM CST on 10/24/22, 373 basis points (bps) higher than its all-time closing low of 0.51% on 8/4/20 (not in table) and 33 bps above its 3.91% average yield for the 30-year period ended 10/24/22 (not in table), according to Bloomberg.

4. The yield on the U.S. 2-year T-note stood 27 bps higher than the yield on the 10-year T-note as of 3:00PM CST on 10/24/22 (see table). This yield spread has been inverted since early July 2022. Over the past 30 years, the yield on the 10-year T-note exceeded that of the 2-year T-note by an average of 110 bps, according to Bloomberg.

5. As of 10/24/22, the federal funds target rate (upper bound) stood at 3.25%, above its 30-year average of 2.46%. The Fed hiked rates by 75 bps in June, July and September. Its next FOMC meeting is scheduled for November 1-2.

6. With the rise in government bond yields throughout much of the globe over the past year, the amount of negative-yielding debt has declined significantly, as measured by the Bloomberg Global Aggregate Negative Yielding Debt Index. The total value stood at $969 billion on 10/24/22, down from $11.65 trillion a year ago.

7. We will continue to monitor the situation to see if high inflation plus any tapering the Fed does to its balance sheet of assets is enough to push bond yields higher in the months ahead.