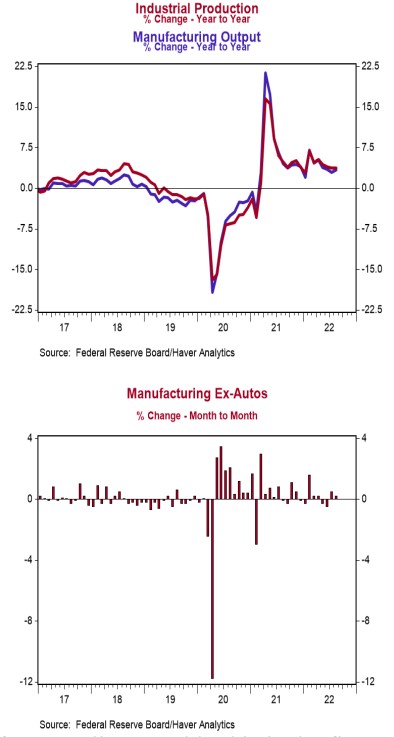

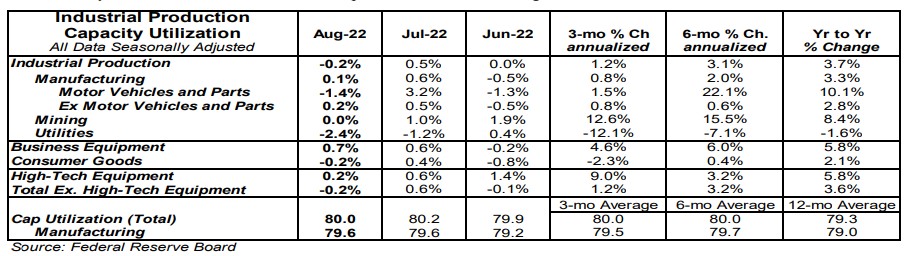

- Industrial production declined 0.2% in August (-0.3% including revisions to prior months), below the consensus expectation of no change. Utilities output fell 2.4% in August, while mining remained unchanged.

- Manufacturing, which excludes mining/utilities, increased 0.1% in August (-0.2% including revisions to prior months). Auto production fell 1.4%, while non-auto manufacturing increased 0.2%. Auto production is up 10.1% in the past year, while non-auto manufacturing is up 2.8%.

- The production of high-tech equipment increased 0.2% in August and is up 5.8% versus a year ago.

- Overall capacity utilization fell to 80.0% in August from 80.2% in July. Manufacturing capacity utilization remained unchanged in August at 79.6%.

Implications:

US industrial activity took a breather in August after hitting a new record high in July. Looking at the details, all the weakness in today’s report came from notoriously volatile categories. The utilities sector, which is largely dependent on weather, was the biggest drag on today’s headline number, falling 2.4%. However, a 1.4% decline in auto production also contributed. Despite the drop in auto production, overall manufacturing activity expanded in August due to a 0.2% gain in non-auto manufacturing. Given the recent trend of Americans shifting their consumption preferences back toward services and away from goods, the resiliency of manufacturing output has been somewhat surprising. That said, production of consumer goods fell 0.2% in August while production of business equipment rose a healthy 0.7%. While it’s too early to tell, this signals that investment in capital goods might be beginning to drive demand for the manufacturing sector as end consumers ease up. Finally, the mining sector was unchanged in August as a slowdown in the extraction of oil, gas, and other minerals offset gains in the drilling of new wells. Notably this is the first time in six months without a gain in the mining sector, and we expect more expansion in the months ahead with oil prices currently still hovering near $90 a barrel, incentivizing new exploration. Unfortunately, there is still no sign of the federal government lending a hand on the energy front, even with the political kryptonite of inflation raging. For example, the recently passed Inflation Reduction Act continues to prioritize green-energy investment, though potential reforms to permitting and the environmental review process for large energy infrastructure projects are being discussed. Overall, despite the shift back toward services, we expect continued modest gains in industrial production in 2022 as demand continues to outstrip supply. For example, this report puts industrial production 2.8% above pre-pandemic levels. Meanwhile, this morning’s report on retail sales shows that after adjusting for inflation, “real” retail sales are up around 13.8% over the same period. This mismatch between supply and stimulus-boosted demand shows why inflation remains uncomfortably high. In other manufacturing news this morning, two separate reports on the factory sector showed mixed results. The Philadelphia Fed Index, a measure of factory sentiment in that region, fell to -9.9 in September from +6.2 in August. Conversely, the Empire State Index, a measure of New York factory sentiment, rebounded to -1.5 in September from -31.3 in August.