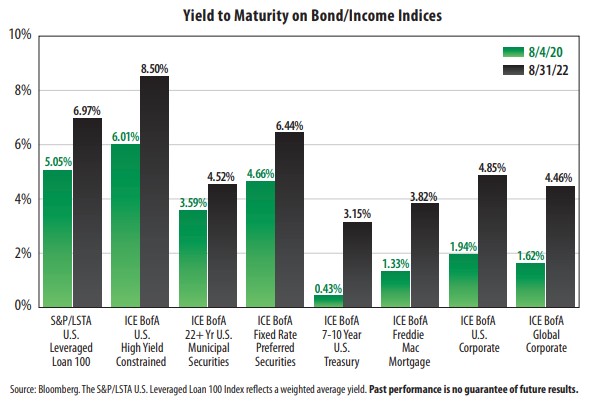

Yield to Maturity on Bond/Income Indices

View from the Observation Deck

1. The benchmark 10-year Treasury Note (T-note) hit an all-time closing low of 0.51% on 8/4/20, according to Bloomberg.

2. From 8/4/20-8/31/22, the yield on the 10-year T-note surged from 0.51% to 3.20%, or an increase of 269 basis points.

3. Keep in mind, while the markets are currently laser-focused on the Federal Reserve's ("Fed") tightening of monetary policy, the Fed did not begin hiking interest rates until March 2022. Since then, the Fed has raised the federal fund's target rate (upper bound) by 225 basis points, from 0.25% to 2.50%. While aggressive, that is still 44 basis points lower than the 269 basis point move in the 10-year T-note since 8/4/20.

4. For the 30-year period that ended 8/31/22, the federal fund's target rate (upper bound) averaged 2.46%, in line with the 2.50% current target rate, according to Bloomberg.

5. Investors should prep for additional rate hikes. Cleveland Fed President Loretta Mester recently announced that she thinks the Fed should take the federal funds rate to 4% or higher by early next year and then hold it there. She does not foresee the Fed cutting rates in 2023.

6. The trailing 12-month Consumer Price Index (CPI) rate stood at 8.5% in July 2022, up 7.5 percentage points from its 1.0% reading in July 2020, according to the Bureau of Labor Statistics. That is significantly higher than its 2.4% average rate for the 30-year period that ended 7/31/22. Robust inflation (CPI) is the primary catalyst behind the surge in interest rates and bond yields, in our opinion.

7. We intend to monitor bond yields moving forward. Current levels are clearly more attractive than where they sat two years ago and they could go higher in the months ahead.