View from the Observation Deck

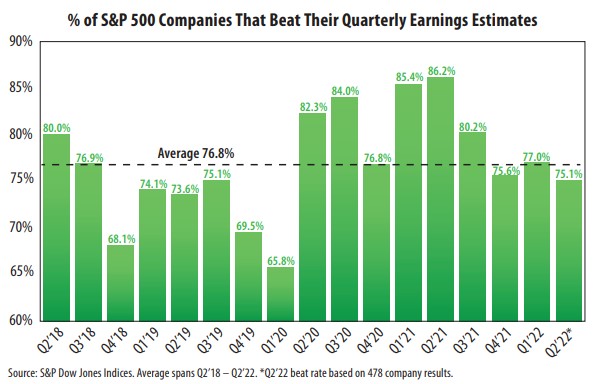

1. As we head into the close of the Q2'22 corporate earnings reporting season, we thought it would be a good time to review the percentage of S&P 500 Index companies that exceed their estimates on a quarterly basis.

2. Equity analysts adjust their corporate earnings estimates on an ongoing basis. Regardless of whether they adjust their estimates up or down, companies typically have a consensus target number or range to hit.

3. From Q2'18 through Q2'22 (17 quarters), the average earnings beat rate for the companies that comprise the index was 76.8%, slightly above the 75.1% beat rate for the 478 companies that have reported results for Q2’22.

4. During the COVID-19 pandemic (Q1’20-Q2’22), the average quarterly beat rate has been 78.8%.

5. The S&P 500 Index posted a cumulative total return of 58.9% for this period (3/31/20-8/31/22), according to Bloomberg.

6. Information Technology (88.2%), Industrials (82.9%), and Health Care (78.7%) have registered the highest earnings beat rates in Q2'22 (not in the chart), according to S&P Dow Jones Indices. Real Estate has the lowest beat rate in the quarter at 58.1%.