View from the Observation Deck

1. We get asked from time to time what our take is on the U.S. dollar and where we think it may be headed next.

2. The dollar is still regarded as the world's primary reserve currency. Its relative strength over time can be influenced by such things as central bank monetary policy, geopolitics, and trade.

3. U.S. investors with exposure to foreign securities, commodities, and the stocks of U.S. multinational companies are particularly vulnerable to fluctuations in the U.S. dollar.

4. Predicting the direction of the dollar, or any currency can be a daunting task, even for professionals who specialize in it. One thing we can provide is some context.

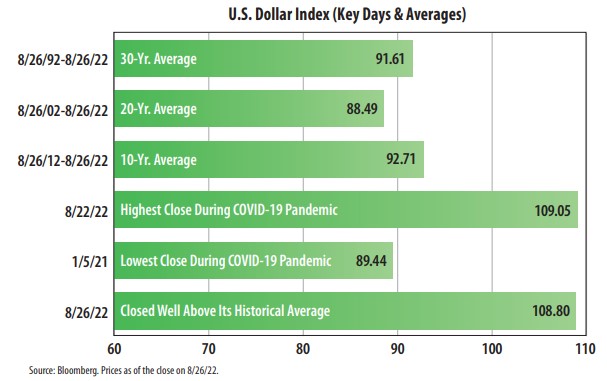

5. As indicated in the chart above, as of 8/26/22, the 10-, 20- and 30-year averages for the U.S. Dollar Index registered readings of 92.71, 88.49, and 91.61, which is a relatively tight range over a span of 30 years. The average of the three averages is 90.94.

6. To add some additional context, over the past 30 years, the index peaked at a reading of 120.90 on 7/5/01, while hitting a period-low of 71.33 on 4/22/08, according to Bloomberg.

7. The U.S. Dollar Index (DXY) has closed trading above the 100 mark in every trading session since 4/13/22, according to Bloomberg. The relative value of the U.S. dollar has been boosted recently by the Federal Reserve's aggressive rate hikes and guidance, the launch of its quantitative tightening program to pare down the assets on its balance sheet ($95 billion per month starting in September), foreign investors using the dollar as a safe haven destination (war between Russia and Ukraine) as well as concerns over how the COVID-19 outbreak in China could impact the global economy, in our opinion.