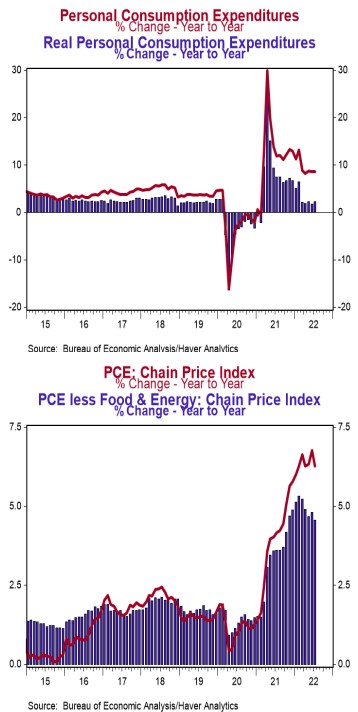

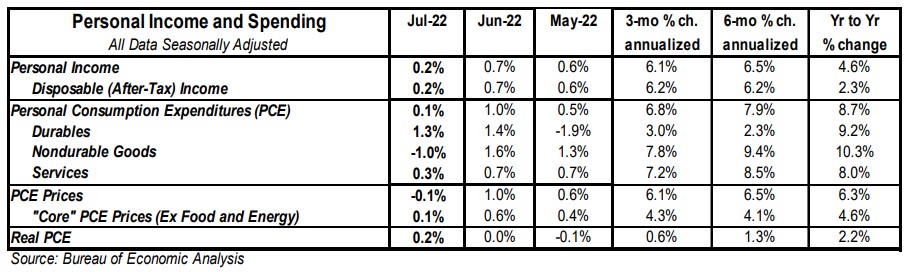

- Personal income rose 0.2% in July versus a consensus expected +0.6%. Personal consumption rose 0.1% in July, versus a consensus expected +0.5%. Personal income is up 4.6% in the past year, while spending has increased 8.7%.

- Disposable personal income (income after taxes) increased 0.2% in July and is up 2.3% from a year ago.

- The overall PCE deflator (consumer prices) declined 0.1% in July, but is up 6.3% versus a year ago. The “core” PCE deflator, which excludes food and energy, rose 0.1% in July and is up 4.6% in the past year.

- After adjusting for inflation, “real” consumption rose 0.2% in July, and is up 2.2% from a year ago.

Implications:

Consumers continued to increase their spending in July, and got a temporary reprieve on rising prices as energy costs fell for the month. The best news in today’s report was in the details of the 0.2% increase in personal income, where private-sector wages and salaries led the way (+0.9% in July) while government transfer payments declined 0.1%. Compared to a year ago, personal income is up 4.6%, lagging the 6.3% rise in inflation of the same period. However, strip out government transfer payments – the economic morphine that Washington used to cover up the pain of bad COVID policies – and personal income is up 7.6% in the past year, with private-sector wages and salaries up a hefty 11.0%. Consumption, meanwhile, rose a modest 0.1% in July and is up 8.7% from a year ago. Spending rose 0.3% on the service side of the economy, while outlays on goods declined 0.2%. We expect growth in services spending will continue to outpace goods in the coming months as the ongoing recovery from COVID restrictions has people back outside and returning to the leisure and travel activities they avoided through much of 2020 and 2021. Since bottoming in April of 2020, consumption has grown at an astronomical 17.2% annual rate and today stands 16.2% above February 2020 levels. But artificially booming demand, the result of government transfers and rapid growth in the M2 money supply, is not a free lunch. While PCE prices – the Fed’s preferred measure of inflation – declined 0.1% in July (the first decline since April of 2020), they remain up 6.3% from a year ago. Core prices, which exclude food and energy, rose 0.1% in July and are up 4.6% from a year ago, neither trend anywhere close to the Federal Reserve’s 2.0% target. The Fed has a tough road ahead in combating the inflation created by policy mistakes over the last two years. Some may argue that today’s data gives Fed Chair Powell a reason to signal an easing in the pace of rate hikes when he speaks at the annual Jackson Hole symposium, but that would be a mistake. While energy prices will ebb and flow, we expect core inflation to remain higher for longer than most anticipate. The Fed would be well served to continue to the fight against inflation at an “expeditious” pace. In recent manufacturing news, the Kansas City Fed index, a measure of manufacturing sentiment in that region, fell to 3 in August from 13 in July. Expect a decline in the national ISM Manufacturing index reported next Thursday, but for the index to remain north of 50, signaling growth.