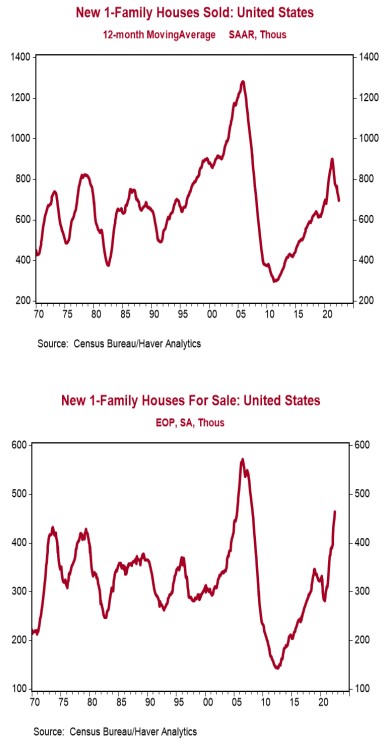

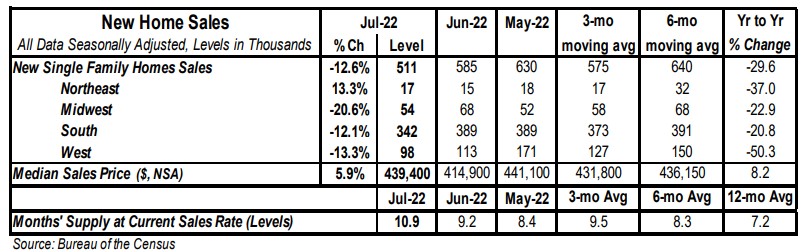

- New single-family home sales declined 12.6% in July to a 0.511 million annual rate, well below the consensus expected 0.575 million. Sales are down 29.6% from a year ago.

- Sales in July fell in the Midwest, West and South, but rose in the Northeast.

- The months’ supply of new homes (how long it would take to sell all the homes in inventory) rose to 10.9 in July from 9.2 in June. The gain was due to both a slower pace of sales and a 14,000 unit increase in inventories.

- The median price of new homes sold was $439,400 in July, up 8.2% from a year ago. The average price of new homes sold was $546,800, up 18.3% versus last year.

Implications:

Recent reports on the US housing market have been ugly, and the numbers on new home sales in July were no different. The headline decline of 12.6% was the largest drop in eighteen months, pushing the sales pace in July to the lowest level since 2016. Though we continue to believe the broader US economy remains out of recession, the housing market is a different story with sales of new homes now down more than 50% from the peak back in August of 2020. The main issue is declining affordability. While rapidly rising prices have been an issue in the housing market throughout the COVID-19 pandemic, 30-year mortgage rates now sit just below 6%, adding to the burden. Assuming a 20% down payment, the change in mortgage rates and home prices just since December amount to a 36% increase in monthly payments on a new 30-year mortgage for the median new home. No wonder sales have slowed down! On top of this, after falling for two months in a row, median sales prices posted a gain of 5.9% in July. Although a lack of inventory has certainly contributed to price gains in the past couple of years, that should not be as much of a problem going forward. The months’ supply of new homes (how long it would take to sell the current inventory at today’s sales pace) is now up to 10.9, the highest level since 2009. Although the months’ supply of completed homes is still a relatively low 1.1, that’s risen lately due to both more single-family homes being completed and rising cancellation rates on purchases. Meanwhile, builders still have plenty of homes under construction that they will strive to finish in the next several months. That process, generating more finished supply, should help curtail price gains and, in turn, stabilize home sales, as well. This is not the housing bust of the 2000s, a period that followed both home prices and the pace of construction getting well above fundamentals. The housing market is weaker than the broader economy but will not lead to a crisis or a massive reduction in housing starts from recent levels. In other news this morning, the Richmond Fed index, a measure of mid-Atlantic manufacturing sentiment, fell to -8 in August versus 0 in July. Regional Fed reports have been volatile of late, but we still expect growth at a national level.