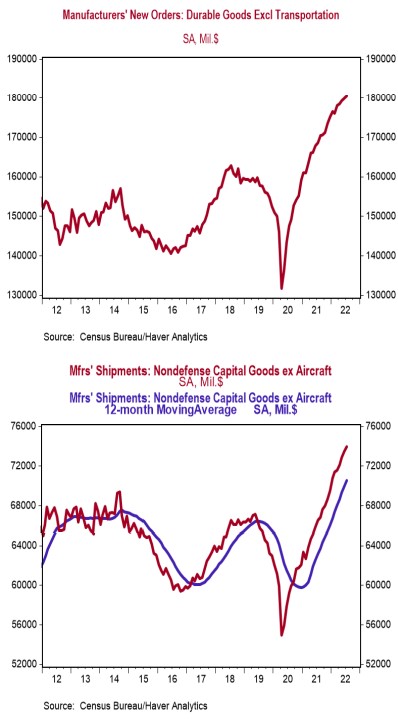

- New orders for durable goods were unchanged in July (+0.2% including revisions to prior months), lagging the consensus expected rise of 0.8%. Orders excluding transportation increased 0.3% in July, narrowly beating the consensus expected gain of 0.2%. Orders are up 10.8% from a year ago, while orders excluding transportation are up 7.1%.

- A large decline in orders for defense aircraft in July was offset by rising orders for commercial aircraft, fabricated metal products, and machinery.

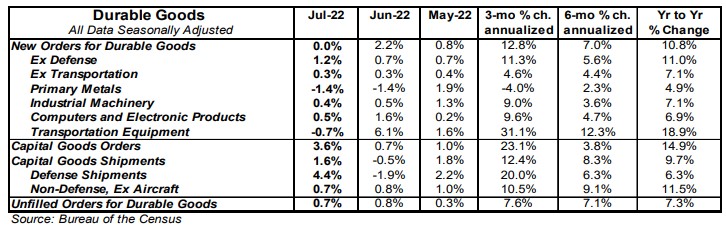

- The government calculates business investment for GDP purposes by using shipments of non-defense capital goods excluding aircraft. That measure increased 0.7% in July. If unchanged in August and September, these shipments will be up at a 6.4% annualized rate in Q3 versus the Q2 average.

- Unfilled orders rose 0.7% in July and are up 7.3% in the past year.

Implications:

The unchanged reading on new orders for durable goods in July was better than the headline number suggests, as broad-based growth was offset by concentrated declines in typically volatile categories. Orders activity was largely positive, with primary metals (-1.4%) and transportation (-0.7%) the two exceptions. Transportation orders can swing wildly from month to month as aircraft orders tend to come in chunks rather than steadily over time. That was the case again in July, as defense aircraft orders fell a whopping 49.8% (following a 78.1% rise in June), but were partially offset by rising orders for commercial aircraft (+14.5%) and autos (+0.2%). Excluding transportation, orders rose 0.3% in July, coming in slightly above the consensus expected +0.2%. Orders for fabricated metal products (+1.2%), machinery (+0.4%), and computers and electronic products (+0.5%) all rose, more than offsetting the decline in orders for primary metals (-1.4%). Further back in the process, unfilled orders continue to rise, suggesting activity will remain positive as companies battle to keep up with demand that is outpacing supply. One of the most important pieces of today’s report, shipments of “core” non-defense capital goods ex-aircraft (a key input for business investment in the calculation of GDP), rose 0.7% in July. If unchanged in August and September, these orders would be up at a 6.4% annualized rate in Q3 versus the Q2 average, providing a tailwind for third quarter GDP. Orders for durable goods have recovered sharply since the pandemic, up 71.9% from the April 2020 bottom and now sit 18.1% above the pre-pandemic high set in February 2020. In other recent news, yesterday the Federal Reserve released its monthly report on the M2 money supply for July. The best news in the report is that M2 growth has moderated year-to-date, up at a 1.8% annualized rate through the first seven months of 2022. That’s well below the 13.8% annualized growth over the same period in 2021, or the 35.4% annualized surge in the first seven months of 2020 as Congress and the Fed bypassed the fire hose and simply opened the stimulus hydrant to full blast. The moderation in M2 growth will help control inflation pressures from building even further, but past actions have the Fed continuing to battle from behind the curve.