View from the Observation Deck

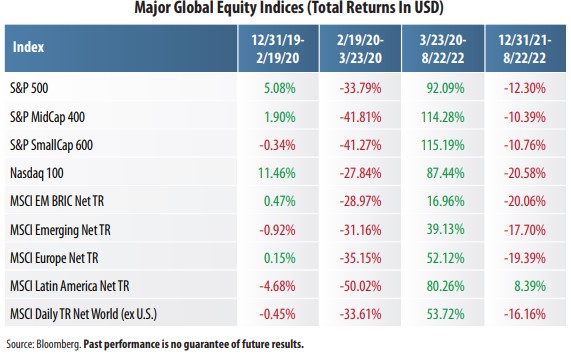

1. Today's blog post features the total return performance figures for the major global stock indices over four specific periods since the start of 2020.

2. The first column of total returns in the table above indicates that, with the exception of the S&P SmallCap 600 Index, U.S. equities were outperforming their foreign

counterparts prior to the peak in the S&P 500 Index on 2/19/20.

3. Due largely to the onset of coronavirus (COVID-19), a major shift in sentiment occurred after the close of trading on 2/19/20. The second column of total returns captures the depth of the sell-off in the stock market in the U.S. and abroad.

4. The S&P 500 Index actually crossed over into bear market territory (a 20% or more price decline from the most recent high) at the close of trading on 3/12/20. It only took 16 trading days, the fastest path to a bear market ever. The sell-off did not cease until 3/23/20.

5. The third column of total returns shows the rebound in progress. This includes the market (S&P 500 Index) dipping into bear market territory for a second time, selling off 23.55% from its all-time closing high on 1/3/22 through its 2022 bottom on 6/16/22. U.S. equities are significantly outperforming their foreign counterparts.

6. The last column reflects the year-to-date total returns through 8/22/22. With the exception of the Nasdaq 100 Index, it has been more of the same with respect to U.S. stocks outperforming most of the foreign stock indices, albeit by a narrower margin. Latin America has benefitted from the rise in commodity prices, including oil.

7. From 12/31/19-8/22/22, the U.S. dollar rose by 13.13% against a basket of major currencies, as measured by the U.S. Dollar Index (DXY), according to Bloomberg. The jump in the U.S. dollar likely provided a drag on the performance of unhedged foreign securities held by U.S. investors over the period, in our opinion.

8. Foreign stocks look less expensive than U.S. equities based on their forward-looking price-to-earnings (P/E) ratios. Bloomberg's 2022 year-end P/E estimates for the major indices in the table are as follows (8/22/22): 18.23 (S&P 500); 13.38 (S&P MidCap 400); 13.28 (S&P SmallCap 600); 23.69 (Nasdaq 100); 11.67 (MSCI BRIC); 11.28 (MSCI Emerging); 11.84 (MSCI Europe); 6.21 (MSCI Latin America); and 12.21 (MSCI World ex-U.S.).