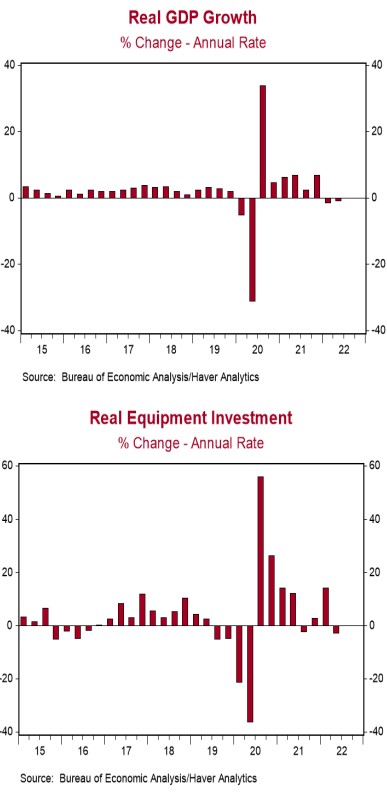

- Real GDP growth in Q2 was revised higher to a -0.6% annual rate from a prior estimate of -0.9%, narrowly beating the consensus expected revision to -0.7%.

- Upward revisions to consumer spending and inventories more than offset a downward revision to home building.

- The largest positive contributions to the real GDP growth rate in Q2 were net exports and consumer spending. The weakest components were inventories and residential investment.

- The GDP price index was revised up to an 8.9% annual growth rate from a prior estimate of 8.7%. Nominal GDP growth – real GDP plus inflation – was revised up to an 8.4% annualized rate from a prior estimate of 7.8%.

Implications:

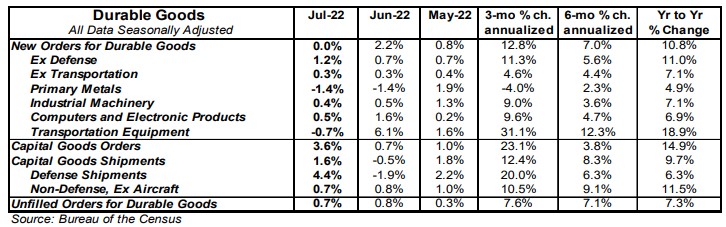

Today’s second report on Q2 real GDP was revised slightly higher from the initial reading a month ago, declining at a 0.6% annual rate. The upward revision to the overall number was due to stronger consumer spending and inventories, which more than offset a downward revision to home building. However, the most important news today was that corporate profits soared in the second quarter, growing 6.1% versus Q1, up 8.1% from a year ago, and up 26.7% versus the pre-COVID level. Profits in Q2 rose at domestic non-financial companies as well as from operations abroad, but declined at domestic financial corporations. Our capitalized profits model suggests US equities are roughly fairly valued today at current interest rates, although we believe equities will remain range bound until we eventually hit a recession starting sometime in 2023-24. Although some investors think a recession has already started, given two straight quarters of negative real GDP growth, we don’t think that’s right. Now that we have corporate profits for Q2, we also have real Gross Domestic Income (Real GDI), an alternative measure of GDP that is just as accurate. Real GDI grew at a 1.4% annual rate in Q2 after growing at a 1.8% rate in Q1. In addition, so far this year the unemployment rate has dropped, payrolls have expended 471,000 per month and industrial production is up at a 5.1% annual rate. These are just not numbers we’d get in a recession. They suggest real GDI is more accurate right now and the real GDP numbers will eventually be revised positive over the next few years. Where does this all leave the Federal Reserve? Still behind the curve. GDP inflation was revised higher to an 8.9% annual rate in Q2, the fastest pace for any quarter since 1981. GDP prices are up 7.5% from a year ago, nowhere near the Fed’s 2.0% target. Meanwhile, nominal GDP (real GDP growth plus inflation) rose at an 8.4% annual rate in Q2 and is up 9.4% from a year ago. The US economy recovered rapidly from re-opening in 2021. That period of rapid growth is now over. But that doesn’t mean we should take the headline from today’s report at face value and that the US is in a recession. The Fed has a lot more work to do before monetary policy is tight enough to induce a recession. Other news this morning is consistent with continued moderate economic growth. Initial claims for unemployment insurance declined 2,000 last week to 243,000. Continuing claims declined 19,000 to 1.415 million. These figures suggest another month of job growth in August. On the housing front, pending home sales, which are contracts on existing homes, declined 1.0% in July, suggesting another month of tepid existing home sales in August.