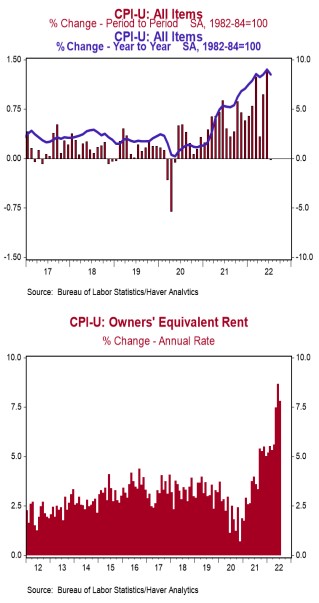

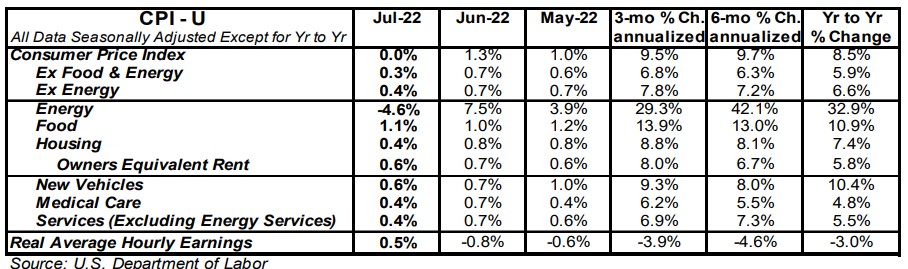

- The Consumer Price Index (CPI) was unchanged in July, below the consensus expected +0.2%. The CPI is up 8.5% from a year ago.

- Energy prices declined 4.6% in July, while food prices increased 1.1%. The “core” CPI, which excludes food and energy, rose 0.3% in July, below the consensus expected +0.5%. Core prices are up 5.9% versus a year ago.

- Real average hourly earnings – the cash earnings of all workers, adjusted for inflation – increased 0.5% in July but are down 3.0% in the past year. Real average weekly earnings are down 3.6% in the past year.

Implications:

Is the inflation scare over? Not by a long shot. Today’s downside surprise to July consumer prices was the mirror-image of June’s surprise to the upside, both of which were driven by the volatile energy sector. Consumer prices were unchanged in July, muted by a 4.6% decline in energy, which followed a 7.5% energy price spike in June. Excluding energy, consumer prices were up 0.4% in July. The decline in energy prices for the month drove the year-ago comparison for the headline index down to 8.5% (versus 9.1% in June). When you look at inflation on a year-ago comparison basis, it probably peaked back in June at 9.1%, but that doesn’t mean inflation is no longer a major problem. In the past two months – taking the surge in June as well as the unchanged overall price level in July – consumer prices are up at an 8.1% annual rate. That is no different than the 8.1% annualized increase in April and May, before the spike and then decline in energy prices. Looking at the details of today’s report, food prices – the other typically volatile category – was a different story from energy, posting its seventh consecutive monthly gain of at least 0.9%, on the back of higher costs for all six major grocery-store food groups. Stripping out food and energy, “core” prices rose 0.3% in July, leaving the year-ago comparison unchanged at 5.9%. Digging into the core data shows persistent inflation pressures that were partially offset by a string of smaller category declines. Housing rents (for both actual tenants and the rental value of owner-occupied homes) continued to increase at an outsized pace in July, rising 0.6%. Notably, in the past two months, rental prices for actual tenants have posted the two largest monthly increases since 1987. Rents have been a key driver for inflation in 2022, and should continue to do so in 2023-24 because they make up more than 30% of the overall CPI and still have a long way to go to catch up to home prices, which skyrocketed during COVID. Other core categories to increase in July were prices for motor vehicle insurance (+1.3%), new vehicles (+0.6%), and hospital services (+0.5%). Meanwhile, several categories that have risen sharply in prior months cooled in July, including prices for airline fares (-7.8%), hotels (-3.2%), and used vehicles (-0.4%). The best news in today’s report was real earnings increasing 0.5%, its first monthly increase in ten months. But take this with a grain of salt, as real earnings are down 3.0% in the last year, and we expect them, at very best, to remain roughly flat in the year ahead. Since February 2020 (pre-COVID), consumer prices are up at a 5.6% annual rate and core prices are up at a 4.2% rate. How did we get here? By forcing an economy to shutdown while simultaneously injecting an unprecedented amount of fiscal and monetary stimulus. Inflation has been – and always is – a monetary phenomenon. To get inflation back down to 2.0%, the Fed needs to focus less on hiking interest rates and more on getting the growth in the money supply under consistent control.