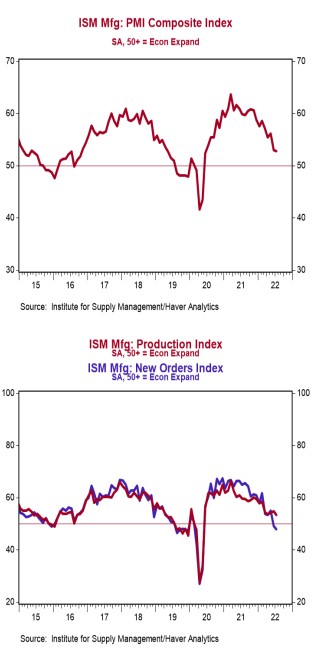

- The ISM Manufacturing Index declined to 52.8 in July, beating the consensus expected 52.0. (Levels higher than 50 signal expansion; levels below 50 signal contraction.)

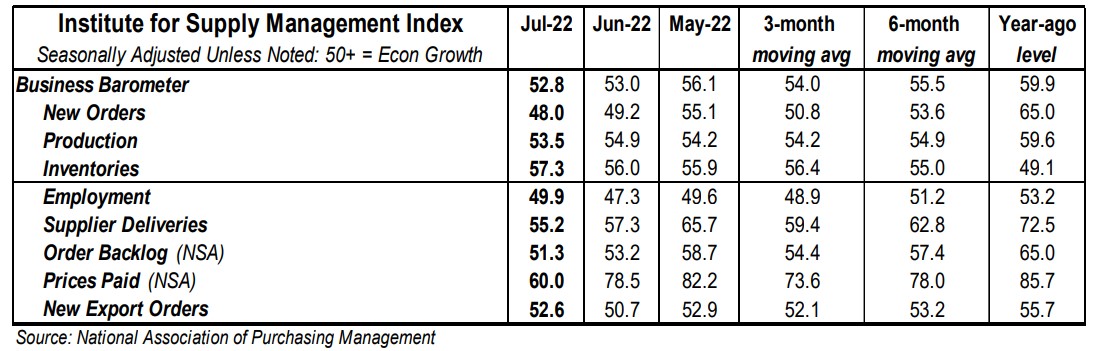

- The major measures of activity were mixed in July. The production index fell to 53.5 from 54.9 in June, while the new orders index fell to 48.0 from 49.2. The supplier deliveries index fell to 55.2 from 57.3 in June, and the employment index rose to 49.9 from 47.3.

- The prices paid index declined to 60.0 in July from 78.5 in June.

Implications:

The manufacturing sector continued to expand in July, though at a slightly slower pace, with eleven of eighteen industries reporting growth. The current slowdown in manufacturing activity is characterized by supply-chain issues and a weakening in demand due to the ongoing shift in consumer preferences away from goods and toward services. Respondent comments in July highlighted shortages of key inputs, but also a drop in the pace of new orders due to fears of a recession and some customers reporting high inventory levels. The result was the new orders index falling to 48.0 in July, dipping further into contraction territory and hitting the lowest reading since the early days of the COVID pandemic. Keep in mind that data on inflation-adjusted consumer spending shows that the actual amount of goods being purchased has been falling since early 2021. However, inflation-adjusted spending on services has continued to expand at a healthy pace as consumption preferences return to “normal.” While the softening of new orders is a negative sign for future manufacturing activity, it should also give US factories time to catch up on all the existing orders they already have in the pipeline. For example, the production index remained in expansion territory at 53.5 in July, signaling factories still have plenty to do. Fewer new orders and more production on existing orders also seems to be easing pressure on supply chains, with the order backlog index falling to 51.3 in July, the lowest in over two years. The supplier deliveries index also signaled progress, falling for the third month in a row and hitting the lowest reading in more than two years as well. Though the employment index remained (barely) in contraction territory at 49.9 in July, the survey comments indicate this doesn’t seem to be due to softening orders, with an overwhelming majority of respondents stating that their companies are still hiring. Finally, the best news in today’s report came from the prices index, which posted the largest monthly drop since 2010, a signal that inflation pressures might have peaked. In other news this morning, construction spending declined 1.1% in June, with large drops in home building easily offsetting small gains in water and communication infrastructure.