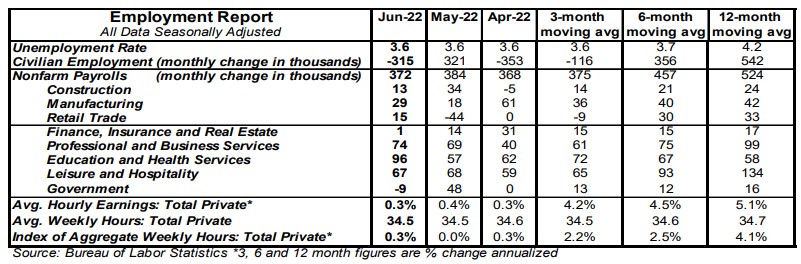

- Nonfarm payrolls increased 372,000 in June, beating the consensus expected 265,000. Payroll gains for April and May were revised down by a total of 74,000, bringing the net gain, including revisions, to 298,000.

- Private sector payrolls rose 381,000 in June but were revised down 34,000 in prior months. The largest increases in June were for education & health services (+96,000), professional & business services (+74,000, including temps), leisure & hospitality (+67,000). Manufacturing increased 29,000 while government declined 9,000.

- The unemployment rate remained at 3.6% in June.

- Average hourly earnings – cash earnings, excluding irregular bonuses/commissions and fringe benefits – rose 0.3% in June and are up 5.1% versus a year ago. Aggregate hours increased 0.3% in June and are up 4.1% from a year ago.

Implications:

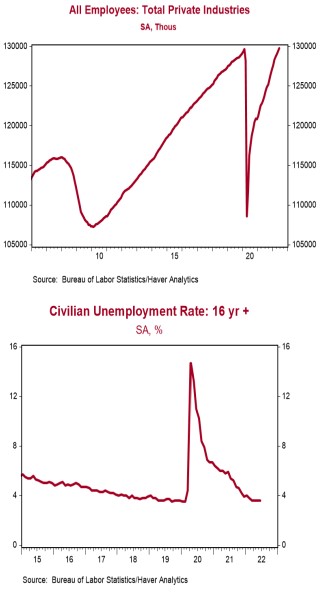

The labor market remains strong, but the details of today’s report were not consistently positive for US workers. Nonfarm payrolls rose 372,000 in June, beating the consensus expected gain of 265,000 even if you discount the increase in June by the downward revisions of 74,000 for April and May. The service sector continues to lead the way, with the fastest gains for education & health, professional & business services, as well as leisure & hospitality. However, manufacturing payrolls rose 29,000 in June, the fourteenth consecutive monthly gain. Total hours worked rose 0.3% in June and are up 4.1% in the past year. So far, so good. But not every part of the report was positive. Civilian employment, an alternative measure of jobs that includes small-business start-ups, declined 315,000 in June, while the labor force dropped 353,000. As a result, even though the unemployment remained at a low 3.6%, the participation rate (the share of adults who are either working or looking for work) slipped to 62.2% from a prior 62.3%. Does this mean we’re already in a recession like some investors fear? Not by a long shot. Payrolls grew 539,000 per month in Q1 and 375,000 per month in Q2. That’s not a recession, not even close. High inflation is still the biggest problem. Average hourly earnings rose 0.3% in June and are up 5.1% from a year ago. In normal times, this would be good news. But we estimate that consumer prices rose 1.0% in June and are up about 8.7% from a year ago. What this means is that “real” (inflation-adjusted) average hourly pay is falling. In addition, it’s important to recognize that the labor market is still not fully healed from COVID and related lockdowns. Although private payrolls are finally up (slightly) from February 2020, total nonfarm payrolls are still 524,000 short of where they were pre-COVID. Where does all this leave the Federal Reserve? Still in need to tighten monetary policy to wrestle inflation under control. Ultimately that entails increasing the risk of a recession, but that recession is unlikely to materialize this year.