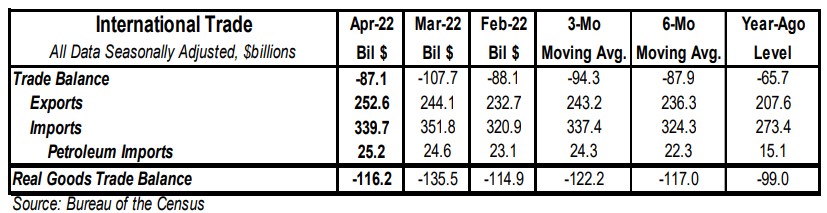

- The trade deficit in goods and services came in at $87.1 billion in April, smaller than the consensus expected $89.5 billion.

- Exports rose by $8.5 billion, led by soybeans, civilian aircraft, and natural gas. Imports declined $12.1 billion, led by finished metal shapes, computers, and other textile apparel & household goods.

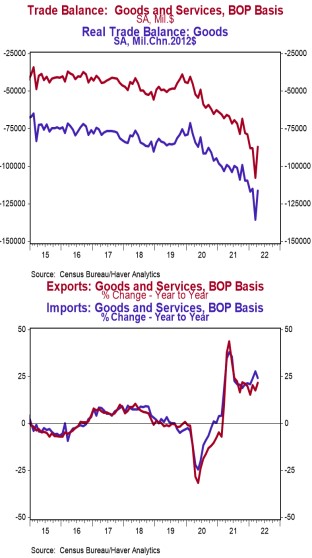

- In the last year, exports are up 21.7% while imports are up 24.3%.

- Compared to a year ago, the monthly trade deficit is $21.4 billion larger; after adjusting for inflation, the "real" trade deficit in goods is $17.2 billion larger than a year ago. The "real" change is the trade indicator most important for measuring real GDP.

Implications:

The trade deficit in goods and services came in at $87.1 billion in April, as rising exports and a decline in imports narrowed the deficit from March's record print. Trade was a major detractor from first-quarter GDP growth, as a more open U.S. saw demand for international goods and services rise, while continued COVID restrictions abroad (most notably in January) hampered US export demand. Since the start of the year, international demand has been on the rise, and that was reflected in strong export activity in April. Imports moderated in April, but that reflects supply chain issues – think China factory output which fell in April to the lowest level since February of 2020 – more than a drop-off in U.S. demand. We like to follow the total volume of trade (imports plus exports), which signals how much businesses and consumers interact across the US border. That measure fell by $3.6 billion in April, but remains up 23.1% versus a year ago, and sits just off the record high set in March. Unfortunately, these massive numbers are driven not only by more demand for goods and services, but also higher prices as inflation has soared. Expect the trade deficit to remain volatile from month to month but generally stay large in the months ahead as the US has recovered from the coronavirus faster than most other countries. In addition, Russia's invasion of Ukraine, and COVID restrictions in China may affect trade patterns for some time. Given massive and artificial government stimulus in the US, both fiscal and monetary, the demand for imports should continue to outstrip the demand for exports to the rest of the world. Supply-chain problems are still a big issue as ports remain overwhelmed in the US, and the tragic war in Ukraine is only adding to the problem. For example, the ports of Los Angeles and Long Beach currently have 25 container ships waiting to be unloaded. Although this is near recovery lows, its well above the 0 - 1 normal level experienced pre-COVID. Also notable in today's report, the dollar value of US petroleum exports again exceeded US petroleum imports. It's too early to say for sure, but this is an encouraging sign that the US is getting back to where it was in 2020 when it was a net petroleum exporter.